Create TradingView Alerts

Why Alerts Matter

Markets move fast—and missing a key setup or trend reversal can cost you. InsiderFinance alerts are designed to keep you in sync with the chart, notify you exactly when a signal triggers, and simplify trade timing across any ticker, time frame, or asset class.

Our alert system supports two methods:

- Automated Alerts: A powerful all-in-one alert that reacts to key events

- Individual Alerts: Precision-level notifications tailored to your strategy

Automated Alerts

Best for: Traders who want full signal coverage with just one alert setup.

What Triggers an Automated Alert?

Each alert is directly tied to what you visually see on your chart, including both trend changes and confirmations:

- Algo Signal: Buy/Sell label appears (green “B” or red “S”)

- Confirm Line Signal: Trend Confirm Line changes direction

- Combined Signal: Algo and Confirm flip together for a high-conviction move

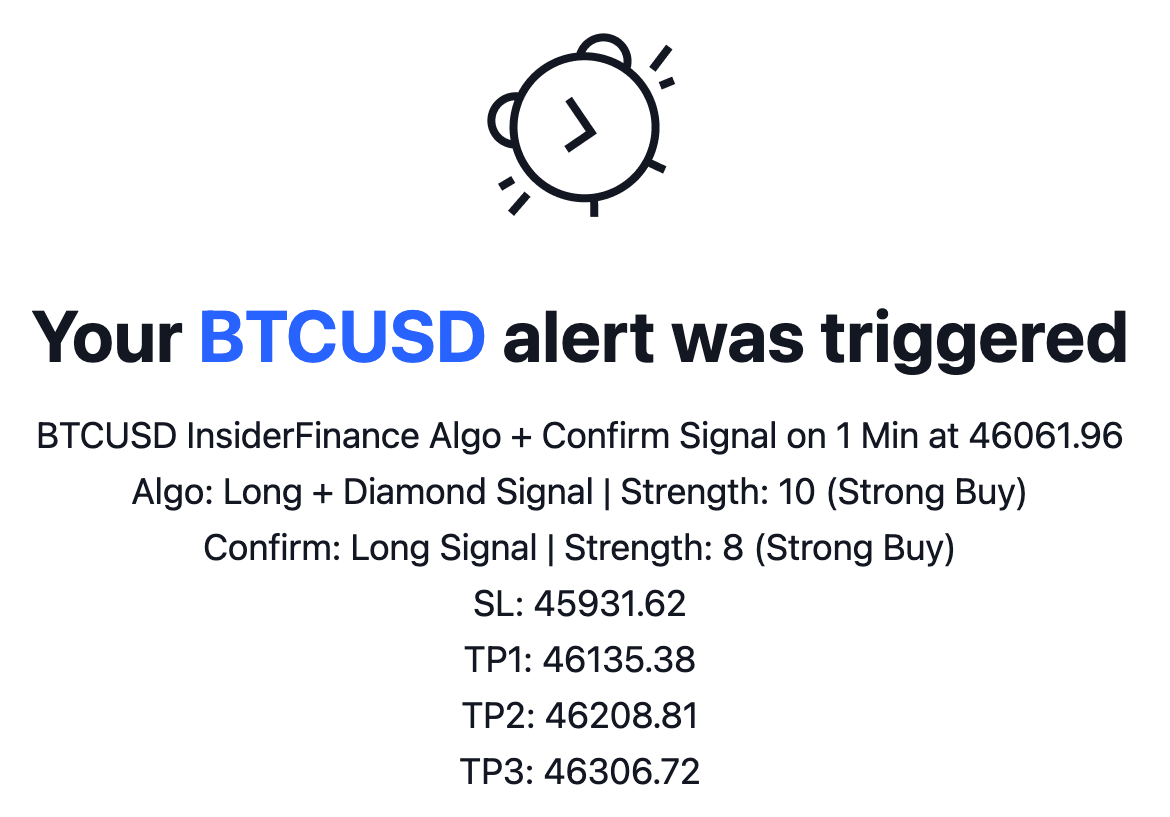

- Diamond Confirmation: A green or red diamond appears—our strongest signal, indicating 90%+ of indicators are aligned

How the Alert Reads on Your Chart

- Buy Signal + Green Diamond

You’ll see a green “B” and a green diamond on the same or nearby candle - Sell Signal + Red Diamond

You’ll see a red “S” and a red diamond aligned - Buy/Sell Without Diamond

The Buy/Sell label appears without a diamond, signaling a trend shift but not full consensus - Trend Shift Alerts

Alert fires when either the Algo or Confirm line changes direction

These align exactly with what you see on the TradingView chart at the bar close—no surprises.

Why Use Automated Alerts?

- One alert gives you complete visibility

- Great for monitoring active positions or multiple tickers

- Ideal if you want alerts to reflect what’s happening on your screen—without extra steps

Steps to Create Automated Alerts

1) Click Create Alert.

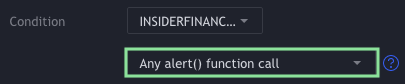

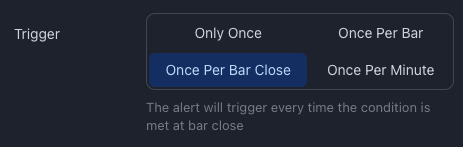

2) Select INSIDERFINANCE ALGO as the condition and make sure you see "Any alert() function call" (Automated Alerts).

3) Choose how you want to be notified (in app or through pop-up), name your alert, and click Create.

That's it! You should now receive alerts on your mobile device or desktop using the method you selected.

Individual Alerts

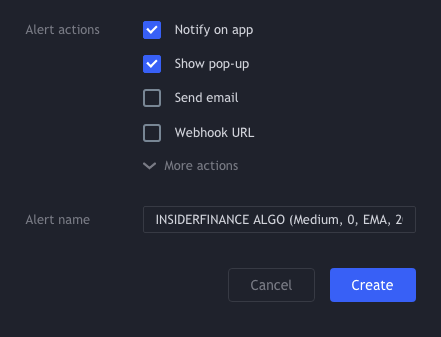

Best for: Traders looking to isolate specific signals—such as only Strong Buy entries—or reduce overall alert volume.

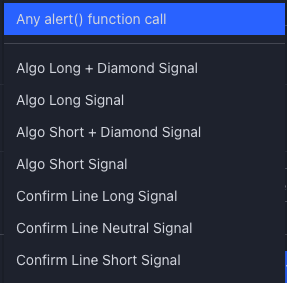

We recommend using these alerts with the Once Per Bar Close setting so you don't receive any false signals:

What You Can Monitor

Each individual alert corresponds to a clear visual signal on the chart, allowing you to respond to exactly the setup you're waiting for:

| Alert Type | Chart Visual | Description |

|---|---|---|

| Algo Long Signal | Green “B” label (Buy Signal) | Algo has flipped bullish, trend reversal underway |

| Algo Long + Diamond | Green “B” + green diamond | Strongest buy setup; 90%+ of indicators are in bullish agreement |

| Algo Short Signal | Red “S” label (Sell Signal) | Algo has flipped bearish, early warning of reversal |

| Algo Short + Diamond | Red “S” + red diamond | Strongest short setup; 90%+ of indicators show bearish alignment |

| Confirm Line Long | Trend line turns green; Confirm Line rising | Secondary confirmation that trend is moving up |

| Confirm Line Short | Trend line turns red; Confirm Line falling | Secondary confirmation that trend is moving down |

| Confirm Line Neutral | Trend line flattens (yellow or neutral strength) | Potential consolidation or indecision; helps manage exits or caution flags |

| Bull Confirm Triangle | Green triangle below bar | Additional bullish confirmation signal; often appears just before or with a trend shift |

| Bear Confirm Triangle | Red triangle above bar | Additional bearish confirmation signal; highlights increased downside momentum |

Why Use Individual Alerts?

- Perfect for traders who want specific, high-quality entries

- Cuts down on notifications by only alerting you when your preferred condition is met

- Great for watchlist monitoring—wait for a Strong Buy, then take action

We recommend setting individual alerts to “Once Per Bar Close” to avoid false signals and ensure the trend has confirmed.

Choosing Between Automated and Individual Alerts

Choosing the right alert setup depends on where you are in the trade lifecycle and how active you want to be.

| Scenario | Recommended Alert Type |

|---|---|

| Monitoring open positions | Automated |

| Watching for strong entries on watchlist | Individual (Strong Buy/Sell) |

| Following multiple time frames or tickers | Automated |

| Only want to enter on high-conviction signals | Individual |

| Want to be notified of any change | Automated |

Pro Tip: Many traders use both. Set up individual alerts to catch ideal entries, then switch to automated alerts after entry to track trend continuation or reversals.

Alert Recommendations

Below are our best practices to help you get the most out of both automated and individual alerts.

Start With Automated Alerts

For most traders, automated alerts are the most efficient way to monitor trend changes and new trade setups without needing to configure multiple signals.

- Covers all major signal types: Algo flips, Confirm Line shifts, and combined signals

- Fires only on confirmed bar closes for high reliability

- Easy to manage: Set once, monitor multiple conditions

These alerts often capture Strong Buy (Long + Diamond) or Strong Sell (Short + Diamond) setups—which typically trigger when our system detects over 90% consensus across all indicators, including Squeeze and Momentum. In other words, when you get an automated alert, it likely aligns with our 4-Point Confirmation System.

Use Individual Alerts for High-Conviction Entries

If you’re scanning tickers and waiting for a precise entry, consider using individual alerts for just the Strong Buy (Long + Diamond) or Strong Sell (Short + Diamond) setups.

This helps you:

- Reduce noise by only receiving alerts on high-probability opportunities

- Focus on watchlist tickers that are close to setup

- Avoid missing a breakout when you’re away from the screen

As shown above, we recommend using “Once Per Bar Close” to make sure the signal has confirmed before you take action.

After Entry: Switch Back to Automated

Once you're in a trade, switch to an automated alert on that ticker to stay updated on any trend changes.

This allows you to:

- Get notified if the trend weakens or reverses

- Catch Confirm Line shifts or new opposite-side signals

- React faster to manage risk or lock in profits

For example, if you enter TSLA after a Strong Buy alert, keeping an automated alert active will let you know if the Confirm Line turns neutral or a Short Signal prints—both strong cues to consider exiting or tightening your stop.

Add Confluence

Alerts are most powerful when used in context—not isolation. Use them alongside:

- Support & Resistance Zones

- Bollinger Bands

- Options Flow or Dark Pool Activity

This multi-layered approach improves accuracy and gives you greater confidence in every trade decision.

Why Your Alerts Might Not Match the Chart

If you ever notice an alert firing that doesn't align with what you're seeing, there's a good chance your chart settings have changed since the alert was created. TradingView saves all your settings at the time you create the alert, including:

- Ticker – Alerts only trigger based on the chart symbol you selected

- Time Frame – An alert created on the 15-minute chart won’t match a 5-minute view

- Sensitivity Setting – If you switch from "High" to "Medium" sensitivity after creating the alert, signals may no longer align

- Candle Type – Alerts behave differently on standard candles vs Heikin Ashi due to the nature of smoothed price action

Common Examples of Mismatched Alerts

- You set an alert with High Sensitivity, but later switch back to Medium → Alerts will trigger based on the old (High) setting

- You created the alert on a 15-minute chart, but now you're reviewing the 5-minute → The alert timing will still reflect the 15-minute chart

- You set the alert using Heikin Ashi candles, but now you’re viewing standard candles → Entry/exit signals may not line up due to calculation differences

How to Fix It

If you’ve made any changes to the chart’s ticker, time frame, candle type, or sensitivity, it’s best to:

- Delete the existing alert

- Recreate the alert with your updated settings

This ensures that your alerts always align perfectly with what you see on your chart—giving you full confidence in your signals.