Nancy Pelosi Stock Trading Activity & Portfolio Analysis

Overview

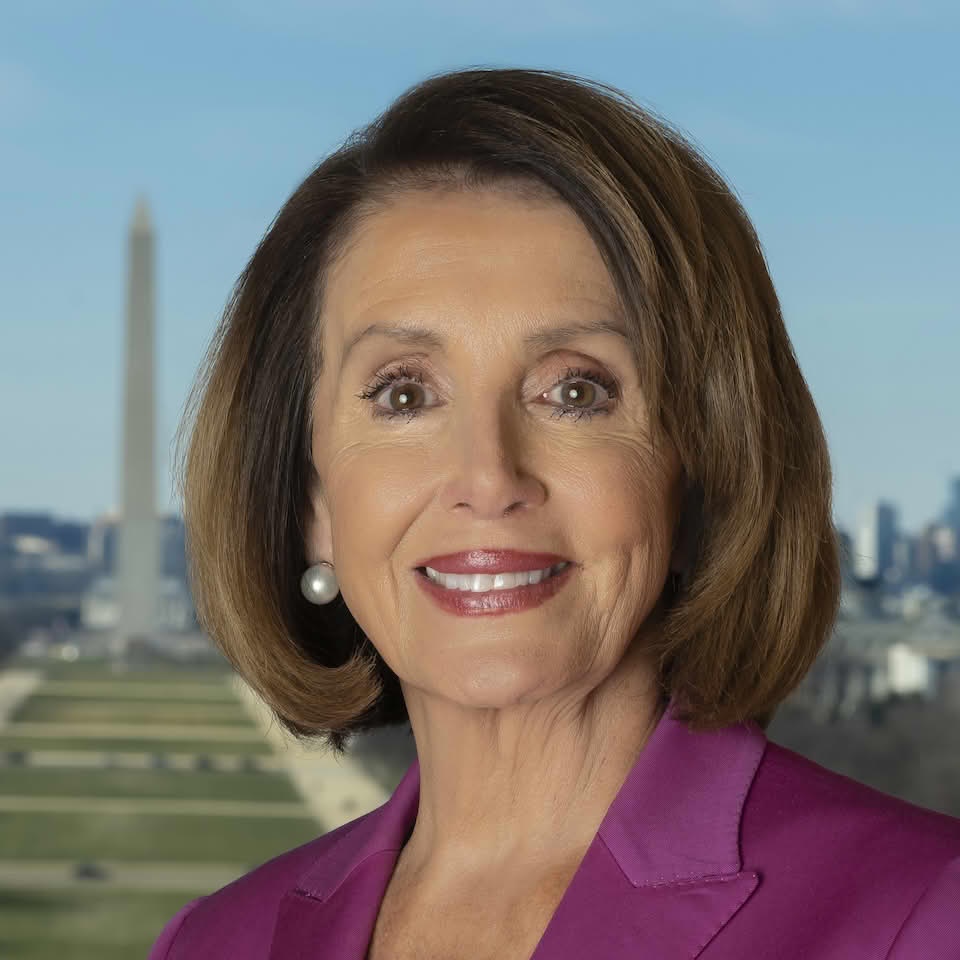

Nancy Pelosi is a Democrat member of the U.S. House of Representatives representing CA District 11. This page provides a comprehensive analysis of Nancy Pelosi's congressional stock trading activity, portfolio performance, and investment strategy.

Nancy Pelosi Net Worth and Trading Performance

Nancy Pelosi's estimated net worth is $582.7M (as of February 2026). Nancy Pelosi has executed 211 stock trades with a total trading volume of $267.8M. The portfolio has generated a total return (realized + unrealized) of $418.1M (+156.1%), with a win rate of 79.7%.

Does Nancy Pelosi Beat the S&P 500?

Yes. Nancy Pelosi's portfolio has outperformed the S&P 500 by 133.0 percentage points. While the S&P 500 would have returned approximately +248.3% over the same period (November 2014 to January 2026), Nancy Pelosi's trading activity generated a return of +156.1%.

This outperformance suggests that Nancy Pelosi's stock picks and timing have been successful relative to the broader market.

Key Performance Metrics

- Total Realized Gains/Losses: $162.0M

- Total Unrealized Gains/Losses: $256.0M

- Win Rate: 79.7% (55 winning trades, 12 losing trades)

- Average Trade Size: $1.3M

- Average Holding Period: 718 days

- Average Return per Trade: $2.0M

Top Holdings

Nancy Pelosi's most frequently traded stocks include:

- AAPL - 35 trades totaling $102.9M

- NVDA - 16 trades totaling $30.0M

- GOOGL - 12 trades totaling $15.3M

- AMZN - 11 trades totaling $13.2M

- V - 13 trades totaling $10.5M

Recent Trading Activity

In the past 12 months, Nancy Pelosi has executed 21 trades. This recent activity demonstrates active engagement in stock market trading while serving in Congress.

Understanding Congressional Stock Trading

Members of Congress are required to disclose stock trades within 45 days of the transaction under the STOCK Act of 2012. These disclosures provide transparency into potential conflicts of interest and allow the public to track the investment activities of elected officials.

Why Track Congressional Trades?

Congressional trading activity is closely watched because:

- Information Advantage: Members of Congress may have access to non-public information through committee work and briefings

- Policy Influence: Legislators vote on policies that can directly impact specific industries and companies

- Accountability: Public disclosure helps ensure officials are making decisions in the public interest

Data Sources and Methodology

Our analysis combines data from:

- Official Congressional Disclosures: Required filings under the STOCK Act

- Financial Market Data: Real-time stock prices and historical performance data

- Performance Calculations: Profit/loss calculations based on disclosed transaction dates and amounts

- Initial Net Worth Estimates: Since Congress members are not required to disclose their net worth or portfolio positions before taking office, we use publicly available estimates from financial disclosure ranges and media reports

For portfolio positions held prior to taking office, we assume these undisclosed positions grow at the same rate as the S&P 500. Since we use the S&P 500 as our performance benchmark, this methodology effectively isolates the impact of their disclosed trading activity while in Congress, allowing us to measure whether their stock picks truly beat the market.

Disclaimer

This analysis is for informational purposes only and should not be considered investment advice. Past performance does not guarantee future results. Congressional stock trades are disclosed with delays and reported in ranges, which may affect the accuracy of performance calculations.

Congressional trading activity is closely scrutinized because some believe that members of Congress may use their access to non-public information to gain an advantage in the stock market. We provide this data to promote transparency and allow you to draw your own conclusions.