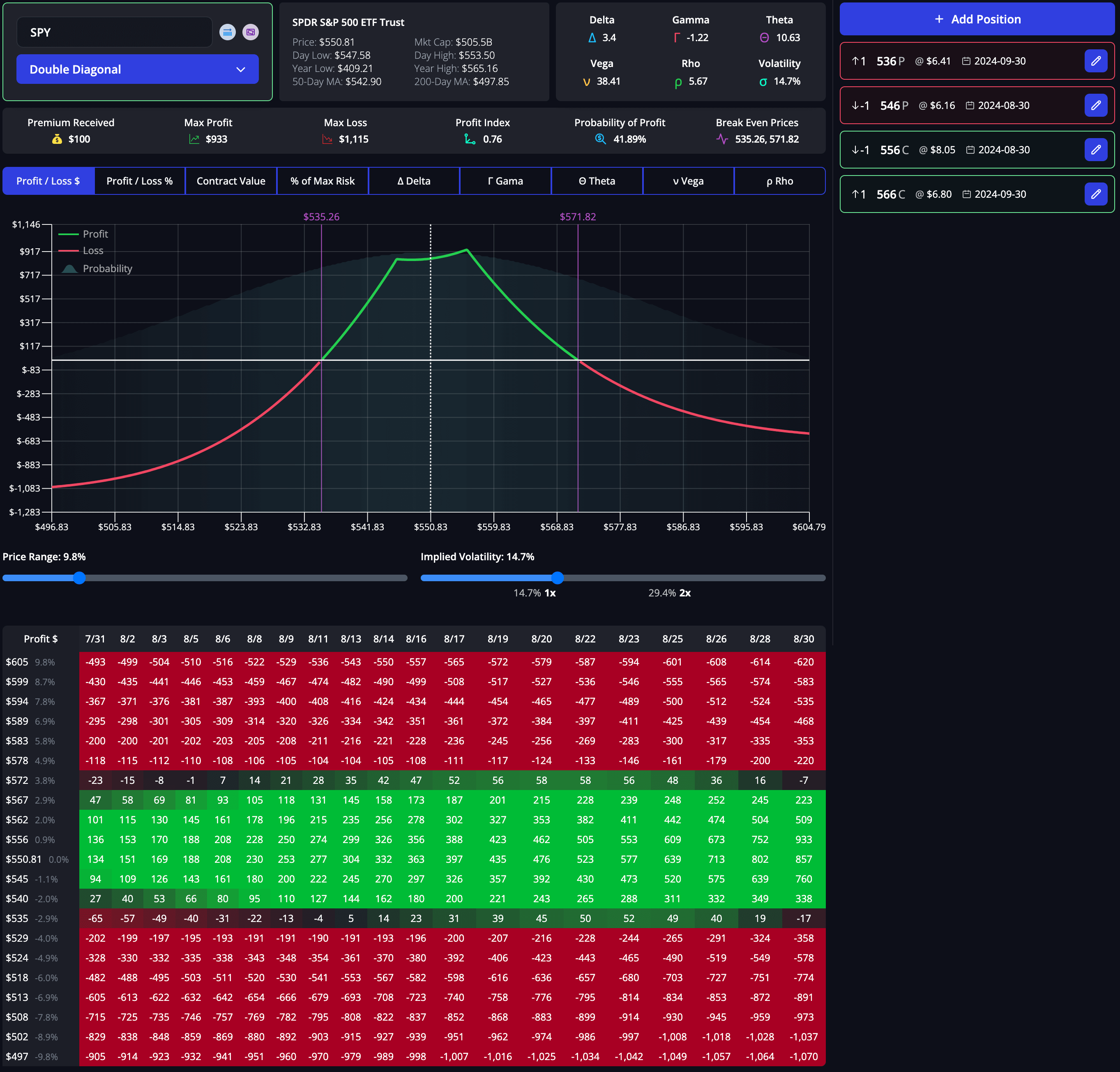

Options Profit Calculator

Most Powerful Options Profit Calculator Ever Created

Real-Time Data | Advanced Analytics | Powerful Visualizations

Options Strategies Simplified.

Profits Maximized.

Finding winning trades has never been easier

Know your chances of success before entering a trade

Explore Strategies

Expiration

Goal

Conditions

Outlook

Skill Level

Trading Style

Bear Call Ladder

- A multi-leg, bearish strategy designed for experienced traders.

- Involves selling one call at a lower strike, buying one at a higher strike, and selling another call at an even higher strike.

- Targets scenarios where the stock price is expected to drop or remain stagnant.

Bear Call Spread

- A credit spread strategy for moderately skilled traders.

- Comprises selling a call at a lower strike and buying a call at a higher strike.

- Intended for scenarios predicting a mild decline in stock price.

Bear Put Ladder

- A complex, multi-leg strategy for seasoned traders.

- Involves selling two puts at different strikes and buying one at a higher strike.

- Targets neutral to slightly bearish market outlooks.

Bear Put Spread

- A debit spread strategy for intermediate traders.

- Comprises buying a put at a higher strike and selling one at a lower strike.

- Suitable for expecting a moderate decline in stock prices.

Bull Call Ladder

- An advanced strategy combining buying and selling calls at different strikes.

- Involves buying a call at a lower strike, selling a call at a higher strike, and selling another call at an even higher strike.

- Targets scenarios where the stock price is expected to rise moderately or remain stable.

Bull Call Spread

- A debit spread strategy for moderately skilled traders.

- Involves buying a call at a lower strike and selling a call at a higher strike.

- Suitable for scenarios expecting a moderate rise in stock prices.

Bull Put Ladder

- A complex, multi-leg strategy for experienced traders.

- Involves selling two puts at different strikes and buying one put at a lower strike.

- Aims at neutral to slightly bullish market outlooks.

Bull Put Spread

- A credit spread strategy for traders with moderate experience.

- Involves selling a put at a higher strike and buying a put at a lower strike.

- Targeted at scenarios predicting a modest increase in stock prices.

Calendar Call Spread

- A horizontal spread strategy involving call options with different expiration dates.

- Involves selling a short-term call and buying a longer-term call at the same strike.

- Aims to benefit from time decay in neutral market conditions.

Calendar Put Spread

- A neutral strategy using put options with different expiration dates.

- Involves selling a near-term put and buying a longer-term put at the same strike.

- Targets profit from time decay and minimal price movement in the underlying stock.

Call Broken Wing Butterfly

- A variation of the butterfly spread, using call options with a skewed risk profile.

- Involves buying calls at lower and higher strikes, and selling more calls at a middle strike.

- Designed to profit from a stock remaining near the middle strike price with reduced risk.

Call Ratio Backspread

- A bullish and volatility-based strategy involving an unequal ratio of sold to bought call options.

- Entails selling one call at a lower strike and buying more calls at a higher strike.

- Targets scenarios expecting a significant increase in the underlying stock's price or high volatility.

Call Ratio Spread

- A bullish and volatility-based strategy involving an unequal ratio of sold to bought call options.

- Entails selling one call at a lower strike and buying more calls at a higher strike.

- Targets scenarios expecting a significant increase in the underlying stock's price or high volatility.

Cash-Secured Put

- A conservative option strategy for beginners involving selling put options.

- Requires holding enough cash to purchase the underlying stock if the option is assigned.

- Targets income generation through premium collection with a willingness to buy the stock at a lower price.

Collar

- A protective strategy combining a covered call and a protective put.

- Involves holding the underlying stock, selling a call option, and buying a put option.

- Aims to limit downside risk while allowing for some upside potential.

Covered Call

- A popular strategy for beginners, combining stock ownership with selling a call option.

- Involves holding a long position in a stock and selling a call option on the same stock.

- Targets income generation through premium collection with a neutral to slightly bullish view.

Covered Short Straddle

- An advanced strategy involving selling both a call and a put at the same strike while owning the underlying stock.

- Aims to profit from premium collection in a stable market with minimal price movement.

- Suitable for scenarios where significant stock movement is not expected.

Covered Short Strangle

- An advanced strategy that involves selling a call and a put at different strikes while owning the underlying stock.

- Aims to earn premium income in a market with limited price movement.

- Suitable for scenarios where the stock is expected to remain within a certain price range.

Diagonal Call Spread

- A strategy combining elements of vertical and calendar spreads using call options.

- Involves buying a long-term call at a lower strike and selling a short-term call at a higher strike.

- Targets profit from both time decay and directional movement of the stock.

Diagonal Put Spread

- Similar to the diagonal call spread, but uses put options for a bearish outlook.

- Involves buying a long-term put at a higher strike and selling a short-term put at a lower strike.

- Aims to benefit from time decay and downward stock movement.

Double Diagonal

- A complex strategy that combines diagonal call and put spreads.

- Involves buying long-term calls and puts at different strikes and selling short-term calls and puts also at different strikes.

- Targets profit from time decay and minimal movement in the underlying stock.

Guts Spread

- A high-risk, high-reward strategy involving the simultaneous buying of in-the-money call and put options.

- Aims to profit from significant price movements in either direction.

- Suitable for scenarios where large stock price swings are anticipated.

Inverse Call Broken Wing Butterfly

- A variation of the butterfly spread, using call options, but with an inverted risk profile.

- Involves selling calls at lower and higher strikes, and buying more calls at a middle strike.

- Designed for neutral markets, aiming to profit from minimal stock movement with a different risk distribution.

Inverse Iron Butterfly

- A complex strategy that combines elements of the straddle and strangle, using both calls and puts.

- Involves selling at-the-money call and put options and buying out-of-the-money call and put options.

- Aims to capitalize on significant price movements in any direction.

Inverse Iron Condor

- A variation of the iron condor strategy, designed to profit from significant price movements.

- Involves buying out-of-the-money call and put options and selling in-the-money call and put options.

- Targets scenarios expecting large stock price swings, but within a certain range.

Inverse Put Broken Wing Butterfly

- A variation of the butterfly spread, utilizing put options with an inverted risk profile.

- Involves selling puts at lower and higher strikes, and buying more puts at a middle strike.

- Designed for markets with minimal movement, aiming for profit with an asymmetric risk distribution.

Iron Butterfly

- A non-directional, income-generating strategy that combines a short straddle and a long strangle.

- Involves selling an at-the-money call and put, and buying an out-of-the-money call and put for protection.

- Targets a specific price range where the stock is expected to remain at expiration.

Iron Condor

- A market-neutral strategy combining two vertical spreads – a bull put spread and a bear call spread.

- Involves selling an out-of-the-money put and call, and buying a further out-of-the-money put and call for protection.

- Aims to profit from minimal stock movement, capturing premium within a defined range.

Jade Lizard

- A premium collection strategy that combines a short put with a short call spread.

- Involves selling an out-of-the-money put and a call spread (selling a call and buying a higher strike call).

- Designed to capture premium without taking on downside risk.

Long Call

- A basic options strategy involving the purchase of call options.

- Suitable for scenarios where a significant increase in the stock price is anticipated.

- Investors buy calls hoping the stock will rise above the strike price before expiration.

Long Call Butterfly

- A market-neutral strategy that involves buying and selling call options at three different strike prices.

- Combines buying one in-the-money call, selling two at-the-money calls, and buying one out-of-the-money call.

- Targets a specific price range where the stock is expected to remain at expiration.

Long Call Condor

- A neutral strategy similar to the butterfly spread but with a wider range of profitability.

- Involves buying one lower strike call, selling one lower middle strike call, selling one higher middle strike call, and buying one higher strike call.

- Aims to profit from the stock price staying within a wider range compared to a butterfly.

Long Combo

- A synthetic strategy that mimics owning the underlying stock, involving buying a call and selling a put at the same strike.

- Aims to profit from a significant upward movement in the stock price.

- Suitable for scenarios where a strong bullish trend is anticipated.

Long Put

- A basic options strategy involving the purchase of put options.

- Suitable for scenarios where a significant decrease in the stock price is anticipated.

- Investors buy puts hoping the stock will fall below the strike price before expiration.

Long Put Butterfly

- A market-neutral strategy that involves buying and selling put options at three different strike prices.

- Combines buying one in-the-money put, selling two at-the-money puts, and buying one out-of-the-money put.

- Targets a specific price range where the stock is expected to remain at expiration.

Long Put Condor

- A neutral strategy similar to the butterfly spread but with a wider range of profitability.

- Involves buying one lower strike put, selling one lower middle strike put, selling one higher middle strike put, and buying one higher strike put.

- Aims to profit from the stock price staying within a wider range compared to a butterfly.

Long Synthetic Future

- A strategy that simulates a long future position using options, involving buying a call and selling a put at the same strike and expiration.

- Designed to mimic the payoff of a future contract with the flexibility of options.

- Suitable for scenarios where significant upward movement in the underlying asset is expected.

Protective Put

- A hedging strategy that involves owning the underlying stock and buying a put option for protection.

- Aims to safeguard against significant downward movement in the stock while retaining upside potential.

- Suitable for stock owners seeking downside protection.

Put Broken Wing Butterfly

- A variation of the butterfly spread using put options, but with an unequal wing width.

- Involves buying puts at lower and higher strikes, and selling more puts at a middle strike.

- Designed for neutral markets, aiming to profit from minimal stock movement with a different risk distribution.

Put Ratio Backspread

- A bearish and volatility-based strategy involving an unequal ratio of sold to bought put options.

- Entails selling one put at a lower strike and buying more puts at a higher strike.

- Targets scenarios expecting a significant decrease in the underlying stock's price or high volatility.

Put Ratio Spread

- A strategy involving buying and selling puts in a particular ratio.

- Typically includes selling more put options at a lower strike price and buying fewer puts at a higher strike.

- Aims to profit from either stable or slightly declining stock prices.

Reverse Jade Lizard

- A premium collection strategy that combines a short put with a short call spread.

- Involves selling an out-of-the-money put and a call spread (selling a call and buying a higher strike call).

- Designed to capture premium without taking on downside risk.

Short Call

- A bearish strategy involving selling a call option.

- Suitable for scenarios where a decrease or minimal increase in the stock price is anticipated.

- Traders sell calls hoping the stock will remain below the strike price or decline.

Short Call Butterfly

- A market-neutral strategy involving selling and buying call options at three different strike prices.

- Combines selling one in-the-money call, buying two at-the-money calls, and selling one out-of-the-money call.

- Targets a specific price range where the stock is expected to remain at expiration.

Short Call Condor

- A neutral strategy similar to the call butterfly but with a wider profit range.

- Involves selling one lower strike call, buying one lower middle strike call, buying one higher middle strike call, and selling one higher strike call.

- Aims to profit from the stock price staying within a broader range compared to a butterfly spread.

Short Combo

- A bearish strategy that mimics a short future position using options, involving selling a call and buying a put at the same strike and expiration.

- Designed to profit from a significant downward movement in the stock price.

- Suitable for scenarios where a strong bearish trend is anticipated.

Short Guts Spread

- A high-risk, premium collection strategy involving selling in-the-money call and put options.

- Aims to profit from premium collection if the stock price remains within a certain range.

- Suitable for scenarios where moderate stock price movements are expected.

Short Put

- A bullish strategy involving selling a put option.

- Suitable for scenarios where an increase or minimal decrease in the stock price is anticipated.

- Traders sell puts hoping the stock will remain above the strike price or rise.

Short Put Butterfly

- A market-neutral strategy that involves selling and buying put options at three different strike prices.

- Combines selling one in-the-money put, buying two at-the-money puts, and selling one out-of-the-money put.

- Targets a specific price range where the stock is expected to remain at expiration.

Short Put Condor

- A neutral strategy similar to the put butterfly but with a wider profit range.

- Involves selling one lower strike put, buying one lower middle strike put, buying one higher middle strike put, and selling one higher strike put.

- Aims to profit from the stock price staying within a broader range compared to a butterfly spread.

Short Straddle

- A high-risk strategy involving selling an at-the-money call and an at-the-money put on the same stock.

- Targets profit from premium collection when the stock remains stable around the strike price.

- Suitable for scenarios where little to no movement in the stock price is expected.

Short Strangle

- A strategy that involves selling an out-of-the-money call and an out-of-the-money put on the same stock.

- Aims to profit from premium collection if the stock price stays within a wide range around the strike prices.

- Suitable for scenarios expecting little volatility in the stock price.

Short Synthetic Future

- A bearish strategy that mimics a short future position using options, involving selling a call and buying a put at the same strike and expiration.

- Designed to profit from a significant downward movement in the stock price.

- Suitable for scenarios where a strong bearish trend is anticipated.

Straddle

- A strategy involving buying both a call and a put option at the same strike price and expiration.

- Aims to profit from significant movement in either direction of the underlying stock.

- Suitable for scenarios where large price swings are anticipated, regardless of direction.

Strangle

- Similar to a straddle, this strategy involves buying a call and a put option, but with different strike prices.

- The call strike is typically higher and the put strike lower than the current stock price.

- Aims to profit from significant price movement in either direction, with more flexibility than a straddle.

Strap

- A bullish variation of the straddle, this strategy involves buying two call options and one put option at the same strike price and expiration.

- Aims to profit from significant upward movement in the stock price, while still covering potential downward movement.

- Suitable for scenarios where a significant upward price swing is anticipated, with a hedge against downward movement.

Strip

- A bearish variation of the straddle, this strategy involves buying two put options and one call option at the same strike price and expiration.

- Aims to profit from significant downward movement in the stock price, while still covering potential upward movement.

- Suitable for scenarios where a significant downward price swing is anticipated, with a hedge against upward movement.

Synthetic Put

- A strategy that mimics a long put position using options and stocks, involving selling a stock and buying a call option at the same strike.

- Designed to profit from a significant downward movement in the stock price, similar to owning a put option.

- Suitable for scenarios where a bearish trend is anticipated in the underlying stock.

Options Profit Calculator

What is an Options Profit Calculator?

An options profit calculator is a powerful tool designed to help traders and investors estimate the potential profit or loss of their options trades. The calculator provides a detailed analysis of various scenarios by inputting specific details about an options contract, such as the strike price, expiration date, and the current market price of the underlying asset. This includes potential outcomes at different stock prices, helping traders make informed decisions.

The calculator factors in key variables like volatility, time decay, and interest rates, offering a comprehensive view of how these elements impact the trade. Whether you are considering buying calls, puts, or employing complex strategies like spreads or straddles, an options profit calculator is essential for visualizing and planning your trades effectively. It serves as a critical tool for both novice and experienced traders, enabling them to optimize their trading strategies and manage risk effectively.

Benefits of Using an Options Profit Calculator

Using an options profit calculator offers numerous benefits that can significantly enhance your trading experience:

- Risk Management: One of the most crucial aspects of trading is managing risk. An options profit calculator lets you see potential losses and gains under various market conditions, helping you plan your trades and set stop-loss levels effectively.

- Informed Decision-Making: An options profit calculator helps you make informed trading decisions by providing a clear picture of potential outcomes. You can evaluate the impact of different market scenarios on your options positions, ensuring you choose strategies that align with your risk tolerance and investment goals.

- Strategy Optimization: Options trading involves a wide range of strategies, from simple buys to complex multi-leg positions. An options profit calculator lets you test and compare these strategies, helping you identify the most profitable approach for your market outlook.

- Time Efficiency: Manually calculating the potential outcomes of options trades can be time-consuming and prone to errors. An options profit calculator automates this process, providing accurate results quickly and saving you valuable time.

- Educational Tool: For those new to options trading, an options profit calculator serves as an excellent educational resource. It helps you understand how different factors, such as volatility, time decay, and changes in the underlying asset’s price, impact your trades.

- Enhanced Confidence: Knowing the potential outcomes of your trades can boost your confidence. By visualizing different scenarios and understanding the possible results, you can trade more decisively and reduce the emotional stress often associated with trading.

An options profit calculator is indispensable for anyone involved in options trading. It enhances your ability to manage risk, make informed decisions, optimize strategies, and save time, all while providing an educational platform to deepen your understanding of options trading dynamics. For those seeking the best options profit calculator, tools like InsiderFinance are highly recommended for their comprehensive features and user-friendly interface.

Options Profit Calculator FAQs

What is an options profit calculator?

An options profit calculator is a tool that estimates the potential profit or loss of an options trade. By inputting details such as strike price, expiration date, and the current market price, the calculator helps traders visualize various outcomes and make informed decisions.

How does an options profit calculator work?

An options profit calculator takes key inputs like the strike price, expiration date, underlying asset price, volatility, and interest rates and uses these factors to simulate different market scenarios, showing potential profits and losses for each situation.

Why should I use an options profit calculator?

Using an options profit calculator is essential for risk management, strategy optimization, and making informed trading decisions. It helps you understand the potential outcomes of your trades, compare different strategies, and manage your trading risks effectively.

Can beginners use an options profit calculator?

Yes, beginners can use an options profit calculator. It’s a valuable educational tool that helps new traders understand the impact of various factors on their trades. It simplifies complex calculations, making it easier to learn and make informed decisions.

What factors does an options profit calculator consider?

An options profit calculator considers factors such as strike price, expiration date, underlying asset price, volatility, time decay, and interest rates. These elements are crucial in determining the potential profit or loss of an options trade.

Are options profit calculators accurate?

Yes, options profit calculators are generally accurate when provided with correct inputs. They use established financial models to simulate outcomes. However, market conditions can change, and unexpected events can affect results, so it’s important to use the calculator as a guide rather than a guarantee.

How can an options profit calculator help with strategy optimization?

An options profit calculator allows you to test and compare different trading strategies. By simulating various scenarios, you can identify which strategies are most likely to be profitable and align with your risk tolerance, helping you optimize your trading approach.

What is the best options profit calculator?

The best options profit calculator depends on your specific needs and preferences. Tools like InsiderFinance are highly recommended for their comprehensive features, user-friendly interface, and accurate simulations.