Understanding Time Decay (Theta) in Options Trading

You’ve made the right call, but your profits are vanishing. The culprit? Time decay. Learn the hidden force that can turn a winning trade into a losing one.

One of the most challenging yet essential concepts for beginner options traders to grasp is time decay, often referred to as theta.

This powerful concept plays a pivotal role in determining the value of options. Misunderstanding it can lead to unexpected losses, even when the underlying stock price moves in your favor.

In this guide, we'll dive deep into the intricacies of time decay, explore its effects on options trading, and provide actionable strategies to help you manage this phenomenon effectively.

What is Time Decay (Theta)?

At its core, time decay refers to the gradual reduction in the price of an option as time progresses, with theta being the Greek letter that represents this rate of decline. Theta measures how much the price of an option is expected to decrease with each passing day, assuming all other factors, such as the stock price and volatility, remain constant.

Unlike owning stocks, where time is not typically a factor, options come with a built-in expiration date. The value of an option is influenced not only by the current price of the underlying asset but also by the time left until expiration.

As the expiration date draws closer, the probability of significant price movement diminishes, causing the option's value to decline. This decay in value can occur even if the underlying stock remains stable or moves in a favorable direction, making it a crucial aspect for options traders to understand.

Why Time Decay Works Against You

For options buyers, time decay can be particularly challenging, often working against you in several ways:

Reduced Probability of Profit

Every day that passes without a significant movement in the stock price reduces the likelihood that the option will end up "in the money" (meaning it has intrinsic value). This shrinking window of opportunity means that as the expiration date approaches, the option’s value begins to erode more quickly, making it harder to achieve profitability.

Favorable Movement Isn’t Always Enough

A common misconception among beginner traders is the belief that if the stock price moves in their favor, their options contract will automatically increase in value. However, if this movement occurs too slowly, time decay can offset the potential gains. For instance, if the stock price starts to move as predicted but does so late in the option's life, the time decay might significantly reduce or even negate any profits.

Exponential Decay Near Expiration

Time decay does not occur at a uniform rate. In the early stages, options lose value relatively slowly. However, as the expiration date draws near, the rate of decay accelerates sharply. This rapid decline can catch traders off guard, particularly those holding options into the final weeks or days before expiration, leading to significant value loss.

How Time Decay Impacts Options Value

To illustrate the impact of time decay, consider an example where you purchase a call option on a stock priced at $50, with an expiration date one month away. Suppose the stock price remains stable for the first two weeks. During this period, you might notice that the option's price has decreased significantly, even though the stock hasn’t moved much. This drop in value is a direct result of time decay—the option is now closer to its expiration, and the market perceives less time for a profitable price movement.

Even if the stock begins to climb in the third week, the lost value due to time decay may outweigh any gains from the price movement, especially if the option is nearing expiration. This example underscores the importance of understanding time decay and its powerful effect on options pricing.

Strategies to Mitigate Time Decay

While time decay can seem like a daunting challenge, there are strategies that traders can employ to mitigate its impact and even use it to their advantage:

Choose Longer Expiration Dates

One of the simplest ways to reduce the impact of time decay is to select options with longer expiration dates. These options are less affected by time decay in the early stages, giving the underlying stock more time to make a favorable move. By choosing longer expirations, you allow yourself a wider window for profit, reducing the pressure to achieve quick gains.

Sell Options to Benefit from Time Decay

Instead of buying options, consider selling them. When you sell an option, you collect the premium upfront and benefit from time decay. As time passes, the value of the option you sold decreases, which can allow you to buy it back at a lower price or let it expire worthless, thereby profiting from the time decay.

Close Losing Trades Early

If an option trade isn’t working out as planned, it's often better to cut your losses early rather than holding onto the position and allowing time decay to erode its value further. This disciplined approach can help you preserve capital and avoid significant losses due to time decay.

Implement Spread Strategies

Advanced options strategies, such as spreads, can also help manage time decay. For example, by simultaneously buying and selling options with different strike prices or expiration dates, you can construct positions that reduce the overall impact of time decay on your portfolio.

How to Master Time Decay

Understanding time decay is the cornerstone of successful options trading. By recognizing how theta can erode your profits, you've already taken a significant step toward refining your trading strategy. But knowledge alone isn't enough—you need the right tools to turn that knowledge into consistent success.

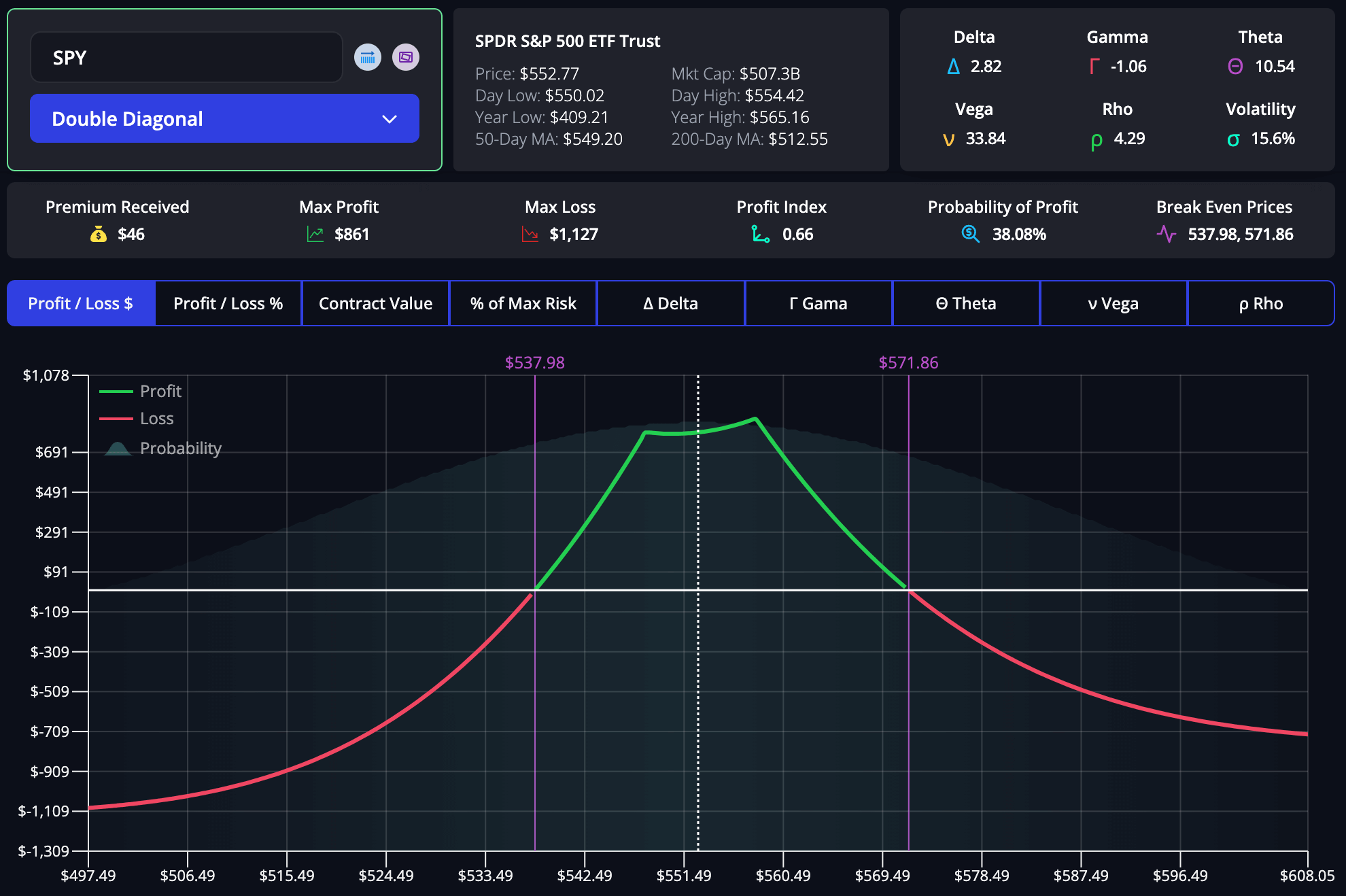

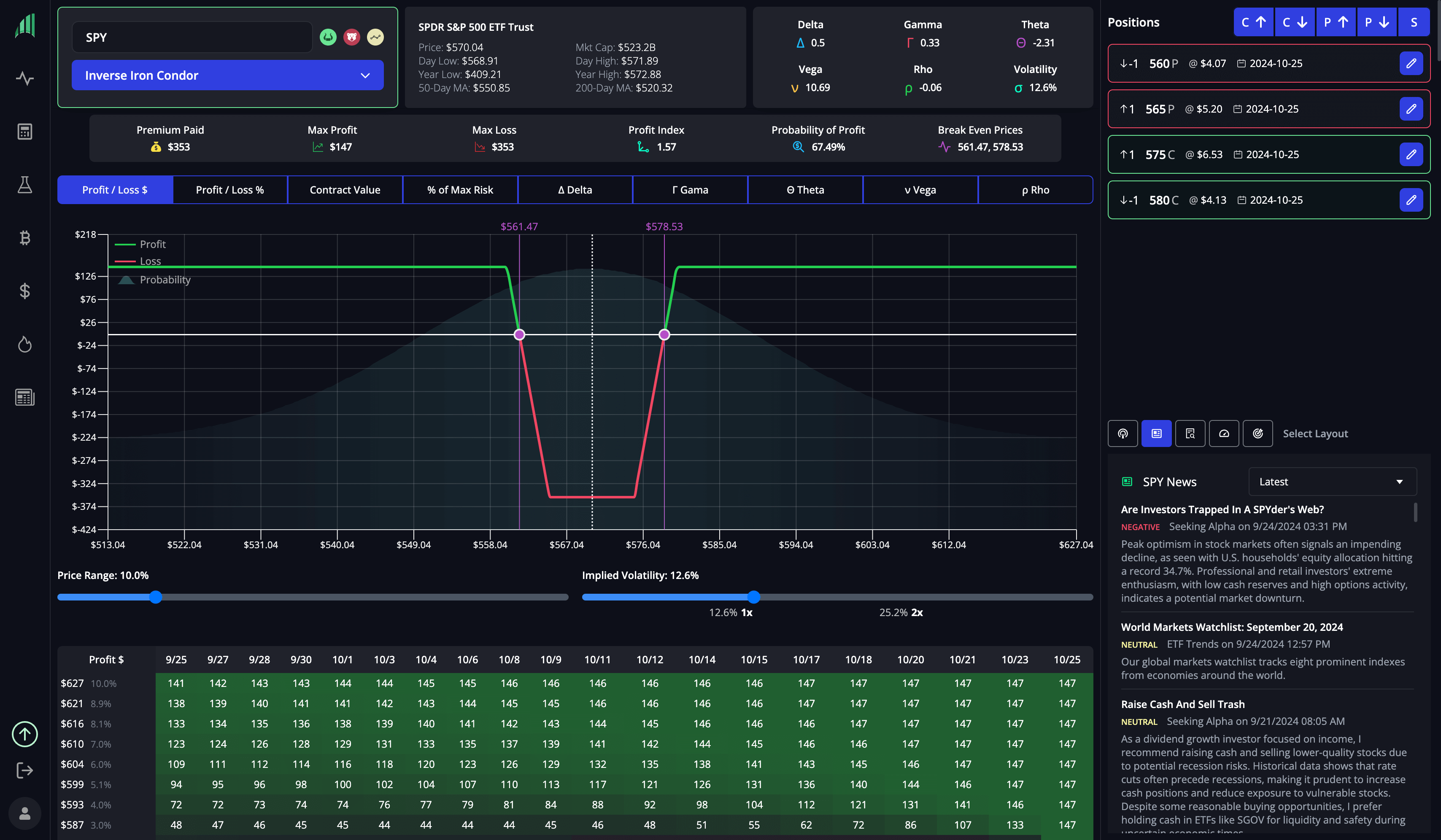

This is where the InsiderFinance Options Profit Calculator comes into play. Designed to empower traders like you, this tool can take your options trading to the next level by helping you make informed, strategic decisions.

Why the InsiderFinance Options Profit Calculator is a Game-Changer:

- Accurate Time Decay Impact Analysis: Quickly see how time decay (theta) will affect your options' value over time, allowing you to make smarter entry and exit decisions.

- Real-Time Profit Projections: Get instant calculations on potential profits or losses based on current market conditions, so you're never caught off guard by theta’s effects.

- Customizable Scenario Planning: Simulate various scenarios, including changes in stock price and volatility, to understand how your option will perform as time decays.

- Optimal Trade Timing: Identify the best times to buy or sell your options, minimizing the negative impact of time decay and maximizing your profits.

- Visual Insights: Easy-to-understand charts and graphs show how theta will influence your options, making complex concepts visually intuitive.

By integrating these powerful features into your trading routine, you can effectively manage the impact of time decay and enhance your profitability.

Don't let time decay chip away at your gains—leverage the InsiderFinance Options Profit Calculator to stay ahead of the curve.

Try it now and see how it can transform your trading strategy!

HIGH POTENTIAL TRADES SENT DIRECTLY TO YOUR INBOX

Add your email to receive our free daily newsletter. No spam, unsubscribe anytime.

FAQs

What is time decay in options trading?

Time decay, also known as theta, refers to the gradual decline in the value of an options contract as it approaches its expiration date.

How does theta affect options prices?

Theta measures the rate at which an option’s value decreases over time. As expiration nears, theta accelerates, leading to faster value erosion.

Can time decay cause you to lose money even if the stock price moves in your favor?

Yes, if the stock price moves slowly or near expiration, time decay can offset potential gains, leading to a loss despite favorable price movements.

How can I mitigate the effects of time decay in options trading?

Mitigate time decay by choosing longer expiration dates, selling options, closing losing trades early, or using spread strategies.

Why does time decay accelerate as the expiration date approaches?

As expiration nears, there’s less time for the stock to move significantly, increasing the rate at which the option loses value.

Is time decay the same for all types of options?

No, time decay impacts out-of-the-money options more significantly as they approach expiration compared to in-the-money options.

What strategies can options sellers use to benefit from time decay?

Options sellers can benefit from time decay by selling options and collecting premiums, profiting as the option’s value decreases over time.

What tools can help traders calculate the impact of time decay on options?

Tools like the InsiderFinance Options Profit Calculator can help traders analyze time decay, simulate scenarios, and optimize their trades.

How does volatility interact with time decay in options trading?

High volatility can temporarily offset time decay, but as expiration nears, the impact of time decay typically overpowers volatility.

What’s the difference between time decay and intrinsic value in options?

Time decay refers to the loss of an option’s value over time, while intrinsic value is the actual profit if the option is exercised immediately.