Why Every Options Trader Needs Risk Management

When it comes to options trading, no concept is more critical than risk management. The potential for both significant gains and catastrophic losses is amplified due to the inherent leverage that options provide.

While many strategies are available—ranging from speculative plays to hedging techniques—what truly sets apart successful traders is their ability to manage downside risk.

In the volatile world of options, consistently applying disciplined risk management principles is the defining factor between long-term success and devastating failure.

The Unique Nature of Options Trading

Options trading is a double-edged sword. It offers high profit potential, but the same leverage that enhances gains can also magnify losses. Unlike traditional stock trading, where you own an asset and can hold it indefinitely, options have expiration dates, limited time frames, and, more importantly, intricate pricing mechanisms. This makes effective risk management a necessity rather than an option. Below are key reasons why mastering risk management is crucial for any options trader.

High Probability of Losses

Options are a zero-sum game, meaning that gains for one trader typically result in losses for another. The majority of options, particularly out-of-the-money contracts, expire worthless. This is an important consideration for traders who may be tempted by the allure of high-reward opportunities.

- According to the Chicago Board Options Exchange (CBOE), approximately 75% of options contracts expire worthless. This statistic is a harsh reminder that most traders who do not adequately control risk are likely to face regular losses.

- Unprepared traders, especially those new to options, often neglect to factor in this high probability of losing their investment when buying options, making sound risk management a necessity to ensure survival in the market.

Leverage Magnifies Risk

The leverage in options trading allows traders to control large amounts of an asset with a relatively small upfront capital investment. This leverage can be incredibly profitable, but it also introduces the risk of rapid, magnified losses.

- For instance, a mere 1% change in the underlying asset's price can lead to a 10% or more change in the value of the option, depending on the contract’s delta and gamma.

- Traders without robust risk controls can find themselves facing steep losses very quickly, potentially wiping out their entire account in a single trade.

- This is particularly true for novice traders who may be drawn to high-risk, high-reward strategies, like buying deep out-of-the-money options with unrealistic expectations of profitability.

Tail Risk and Black Swan Events

In options trading, risk isn’t always obvious. The market is prone to unexpected, rare events, often referred to as "black swan" events, which can cause massive market disruptions. These events are difficult, if not impossible, to predict but can have disastrous effects on portfolios.

- A famous example is the 1987 stock market crash, where numerous traders who failed to hedge their positions or account for such extreme risk found themselves with catastrophic losses.

- Tail risk, or the possibility of extreme market moves, is ever-present, and traders who don’t have appropriate stop-losses, hedging strategies, or protective positions in place are exposed to disproportionate risk.

Emotional Discipline and Cognitive Biases

Risk management isn't just about numbers; it also requires emotional discipline. Cognitive biases, such as confirmation bias (favoring information that confirms one’s preconceptions) or loss aversion (the emotional pain of losing is stronger than the joy of gaining), can cloud judgment. Effective risk management protocols, such as automated stop-loss orders, help traders avoid emotional decision-making.

- Studies on behavioral finance have shown that traders who implement automatic risk controls tend to perform better over the long term compared to those who rely solely on discretion.

Data-Based Insights from Studies on Risk Management

Academic studies and real-world data further back the critical role of risk management in options trading.

- A study by the University of California analyzed the performance of retail options traders and discovered that over 75% of individual options traders lose money. The primary cause of this widespread failure? Poor risk management. Traders frequently over-allocate capital to risky, high-reward positions without protecting against downside risks.

- Institutional firms offer a clear contrast. Firms with rigorous risk management practices—such as consistent position sizing, stop-loss mechanisms, and strict risk-to-reward ratios—consistently outperform those focused on speculative directional trades. A 2007 study by the CFA Institute highlighted this, showing that hedge funds employing strong risk controls achieved better risk-adjusted returns than those that merely sought large directional gains. This demonstrates that long-term success comes from minimizing risk rather than maximizing reward.

HIGH POTENTIAL TRADES SENT DIRECTLY TO YOUR INBOX

Add your email to receive our free daily newsletter. No spam, unsubscribe anytime.

Tailoring Risk Management to Your Strategy

Effective risk management isn’t a one-size-fits-all solution. Each options trading strategy comes with its own unique set of risks, and it’s crucial to tailor your risk management approach accordingly.

For example, a speculative options buyer needs to focus on minimizing losses by setting stop-loss orders or adjusting position sizes. In contrast, a premium seller may need to focus on managing margin requirements and ensuring adequate capital reserves to survive short-term drawdowns.

Employing the right techniques will help protect your capital and ensure long-term success. Below, we dive deeper into some of the most essential risk management tools that should be customized based on your strategy.

Position Sizing: Controlling Risk with Capital Allocation

One of the most practical and powerful tools in risk management is position sizing—the practice of adjusting the size of each trade relative to the amount of risk you're comfortable taking. The rule of thumb among successful options traders is to risk no more than 1-2% of your total trading capital on any single trade. This conservative approach ensures that a single loss will not have a catastrophic effect on your overall portfolio.

For example, if you have $100,000 in trading capital, limiting your risk per trade to $1,000-$2,000 prevents any one bad trade from severely impacting your long-term performance. By employing options strategies that cap potential losses—such as vertical spreads or protective puts—you can further limit the downside, ensuring your trading career remains intact regardless of market volatility.

Stop-Loss Orders: Automated Protection Against Major Losses

Stop-loss orders are an invaluable risk management tool for options traders, providing automated protection by exiting a trade once it reaches a predetermined loss threshold. This helps prevent small losses from escalating into large, portfolio-damaging events, particularly in fast-moving markets.

Setting a stop-loss allows traders to avoid emotional decision-making, as the system will automatically sell the position once it hits the defined price level. By adhering to stop-loss discipline, you not only protect your capital but also maintain a consistent, unemotional trading approach. Advanced traders may use trailing stop-losses, which move with the market and lock in profits as the underlying asset's price increases.

Hedging: A Safety Net for High-Risk Trades

Hedging is another essential risk management strategy that protects against adverse market movements by holding offsetting positions. In options trading, strategies like buying protective puts or using collar strategies can limit your downside exposure while allowing room for upside gains.

For example, if you're holding a long call option on a stock, buying a put option on the same stock can limit your losses if the price of the stock declines. Hedging provides peace of mind, ensuring that even in volatile or uncertain markets, you have a safety net in place. Successful traders often hedge their positions ahead of earnings reports or significant market events to protect their portfolios from unexpected moves.

Diversification: Spreading Risk Across Different Trades

Diversification is an often overlooked but highly effective method for reducing risk. By spreading your trades across different assets, sectors, or strategies, you reduce the likelihood that a single event will significantly impact your entire portfolio. A diversified portfolio ensures that not all your capital is exposed to the same market risks at the same time.

For instance, instead of concentrating all your options trades in one sector, such as tech, you could diversify into energy, healthcare, or financial sectors. This approach minimizes the risk of a sector-wide downturn affecting your performance. Additionally, by incorporating different strategies—like combining short-term trades with longer-term hedges—you create a more balanced risk profile that can weather various market conditions.

Survival Through Risk Management

In the high-stakes world of options trading, survival is the name of the game. No matter how advanced your strategies are, if you don’t manage risk effectively, the market will eventually catch up with you. Successful traders are not those who always make the largest gains but those who consistently protect their capital and manage their downside exposure.

Risk management ensures that a trader can stay in the game long enough to capitalize on future opportunities. By focusing on position sizing, stop-loss orders, and hedging, traders can not only survive market volatility but thrive within it. In options trading, the golden rule is simple: Protect your downside, and the upside will take care of itself.

Elevate Your Trading with InsiderFinance

By incorporating InsiderFinance into your risk management strategy, you gain access to powerful tools designed to optimize your options trading:

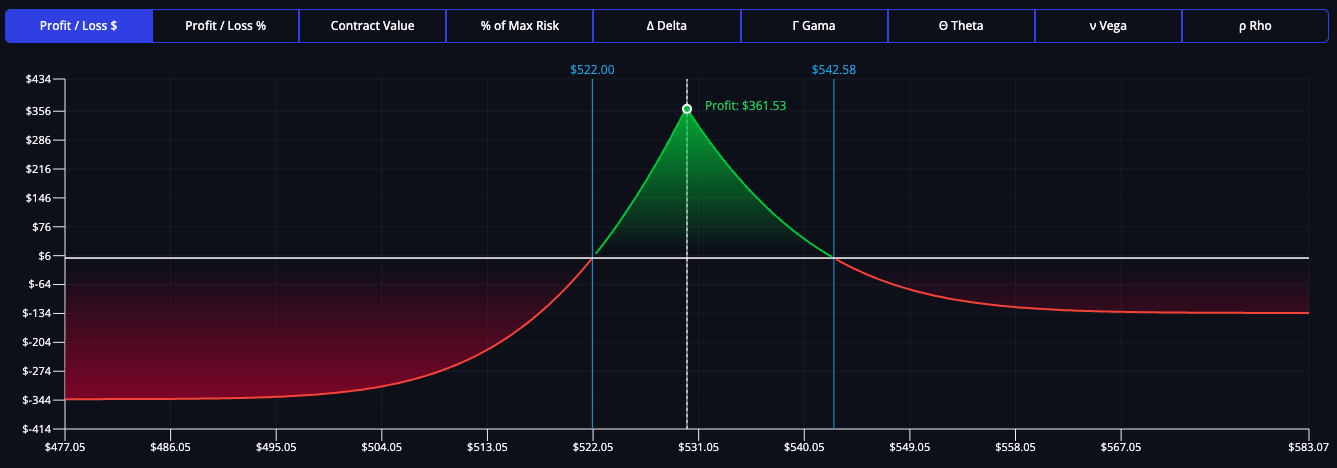

- Options Profit Calculator: Easily calculate potential profits and losses on trades before committing, allowing you to assess risk and reward with precision.

- Real-Time Unusual Options Flow: Identify high-impact trades and follow institutional investors, helping you align your strategy with smart money and minimize downside risk.

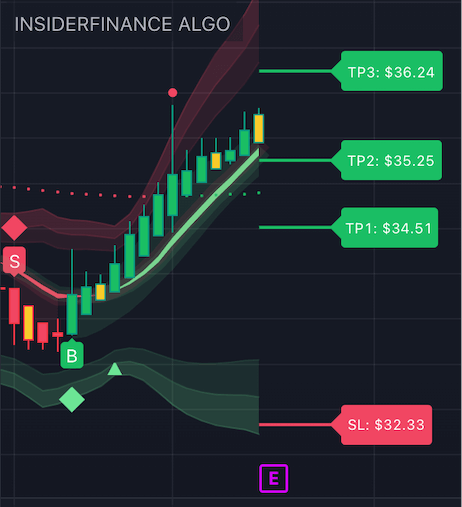

- Comprehensive Technical Analysis Tools: Make informed trades using advanced charting and technical indicators to better time entries and exits with automated take-profit and stop-loss levels, maximizing returns while controlling risk.

These tools from InsiderFinance empower you to trade smarter, safer, and more profitably, giving you the edge needed to succeed in options trading.

HIGH POTENTIAL TRADES SENT DIRECTLY TO YOUR INBOX

Add your email to receive our free daily newsletter. No spam, unsubscribe anytime.

FAQs

Why is risk management important in options trading?

Risk management helps traders control exposure to large losses, ensuring long-term survival and success in options trading.

What are the key risk management strategies for options trading?

Effective strategies include position sizing, stop-loss orders, hedging, and using tools like risk metrics and profit calculators.

How does leverage increase risk in options trading?

Leverage allows traders to control large positions with small investments, but it also amplifies potential losses if the market moves unfavorably.

What percentage of options traders lose money due to poor risk management?

Studies show over 75% of retail options traders lose money, largely due to a lack of proper risk management practices.

What is the role of position sizing in managing options trading risk?

Position sizing limits how much capital is at risk in any single trade, helping traders avoid significant losses from one bad trade.

How can an options profit calculator help with risk management?

An options profit calculator helps traders estimate potential gains and losses, enabling them to make more informed, risk-controlled trades.

What are black swan events in options trading, and how can traders protect themselves?

Black swan events are rare, unpredictable market events. Traders can protect themselves with risk management tools like stop-loss orders and hedging strategies.

How does InsiderFinance improve options trading risk management?

InsiderFinance provides real-time options flow, technical analysis, and risk metrics, helping traders make data-driven decisions and manage risk more effectively.

What are the biggest mistakes traders make when managing risk in options trading?

Common mistakes include over-allocating capital to risky positions, ignoring stop-loss orders, and underestimating market volatility.

How can unusual options flow data help with risk management?

By tracking unusual options flow, traders can identify institutional activity and potential market shifts, helping them adjust their risk exposure proactively.