Maximizing Profits with an Options Profit Calculator

Key Takeaways

- Versatile Trading Strategies: Learn various profitable options trading strategies and how to execute them.

- Accurate Calculations: Understand the importance of using an options profit calculator for precise profit and loss predictions.

- Risk Management: Discover best practices for managing risks and optimizing your trading decisions.

- Common Mistakes: Identify common mistakes in options trading and how to avoid them.

- Practical Insights: Gain practical insights through real-world case studies and scenarios.

Why It Matters

- Enhances Decision-Making: Accurate profit calculations empower traders to make well-informed decisions, minimizing unexpected losses.

- Optimizes Trading Strategies: Leveraging calculators and strategic insights leads to more effective and profitable trading outcomes.

- Protects Investments: Effective risk management practices help safeguard investments and ensure steady returns.

- Improves Success Rate: Understanding and avoiding common mistakes increases the likelihood of trading success.

Do you want to navigate the complexities of options trading with precision and confidence? Discover how options profit calculators can be your game-changing tool for maximizing profits and managing risks effectively.

Introduction to Options Trading and Options Profit Calculators

Options trading represents an intriguing aspect of the financial markets, offering traders a versatile way to hedge, speculate, and leverage market movements with relatively low initial investment.

Unlike straightforward stock trading, options involve contracts granting the holder the right—but not the obligation—to buy or sell an asset at a predetermined price before a specified date. This characteristic provides unique opportunities but also introduces significant complexity and challenges.

Historical Context and Evolution of Options Trading

- Ancient Origins: Options trading dates back to ancient Greece (4th century BCE), where similar financial instruments were used.

- 17th Century: Modern options trading began in Amsterdam with the establishment of the first formal stock exchange.

- Early 20th Century: Standardized contracts and formal trading platforms were developed, paving the way for contemporary options trading.

- 1973 Milestone:

- CBOE Launch: The Chicago Board Options Exchange (CBOE) was founded, becoming the first exchange to list standardized, exchange-traded options.

- Black-Scholes Model: Introduced a theoretical framework for pricing options, revolutionizing the market.

- Today: Options are integral to financial markets, with millions of contracts traded daily across global exchanges, driven by innovations in trading strategies, technological advancements, and increased accessibility for retail investors.

Understanding Options Trading

Options trading involves various components and mechanisms that distinguish it from other forms of trading. At its core, an option is a financial derivative that derives its value from an underlying asset, such as a stock, index, or commodity. Traders utilize options to gain exposure to the price movements of these underlying assets without having to own them directly.

Key Elements of Options Trading

- Contracts: Options are contracts that confer specific rights to the buyer. There are two primary types of options:

- Call Options: Provide the right to buy the underlying asset at the strike price.

- Put Options: Provide the right to sell the underlying asset at the strike price.

- Strike Price: The predetermined price at which the option can be exercised.

- Expiration Date: The date by which the option must be exercised or it expires worthless.

- Premium: The price paid by the buyer to the seller for the option contract.

- Market Volatility: A critical factor in options pricing, reflecting the expected fluctuation in the price of the underlying asset.

Comparison: Options Trading vs. Other Forms of Trading

Options trading offers several unique advantages over other forms of trading, such as stock trading and futures trading. Here’s a brief comparison:

- Leverage: Options provide significant leverage, allowing traders to control large positions with a relatively small investment. This can amplify potential returns but also increases risk.

- Flexibility: Options offer a variety of strategies to profit in different market conditions. Traders can use options to speculate on price movements, hedge against potential losses, or generate income through premium collection.

- Risk Management: Options allow for more precise risk management. For example, buying a put option can protect against a decline in the value of a stock portfolio.

- Limited Risk: When buying options (calls or puts), the maximum loss is limited to the premium paid, unlike futures or margin trading, where losses can exceed the initial investment.

- Complexity: While options provide flexibility and leverage, they are more complex than direct stock trading. Understanding factors such as time decay, volatility, and the Greeks is essential for successful options trading.

The Role of Options Profit Calculators

Given the complexity of options trading, accurate profit calculation is crucial. This is where options profit calculators come into play. These tools help traders forecast potential profits and losses by analyzing various scenarios based on input parameters such as the underlying asset price, strike price, expiration date, and volatility.

An options profit calculator allows traders to visualize different outcomes, enabling more informed decision-making. By inputting different variables, traders can see how changes in market conditions impact their positions. This helps in planning strategies, managing risks, and optimizing trades for better profitability.

Benefits of Using an Options Profit Calculator

- Accurate Predictions: Provides detailed scenarios of potential profits and losses.

- Strategic Planning: Helps in evaluating different strategies and their outcomes.

- Risk Management: Assists in understanding the risk-reward profile of trades.

- Informed Decisions: Enables traders to make decisions based on comprehensive data analysis.

Practical Application for Traders

An options profit calculator is an invaluable tool in your trading arsenal for any skill level. For beginners, it simplifies the process of understanding how different factors affect options pricing and profitability. For seasoned traders, it offers a sophisticated means to refine and enhance trading strategies.

In the following sections, we will delve deeper into the importance of accurate profit calculation, provide a step-by-step guide to using an options profit calculator, and explore how to develop effective trading strategies with this tool.

Why Accurate Profit Calculation Matters

Accurate profit calculation is essential for successful options trading. It helps traders navigate market complexities and make informed decisions, reducing the risk of unexpected losses and missed opportunities.

Importance of Accurate Profit and Loss Predictions

Accurate profit and loss predictions are crucial for several reasons:

- Risk Management: Helps assess risk-reward ratios, set appropriate stop-loss orders, and manage risk exposure.

- Strategic Decision-Making: Enables evaluation of different strategies, including buying or selling options, selecting strike prices, and determining optimal expiration dates.

- Capital Allocation: Ensures efficient capital allocation by investing in trades with the highest potential returns and lowest risks.

- Avoiding Overtrading: Prevents unnecessary transactions that can erode profits through excessive fees and commissions.

Challenges in Achieving Accurate Calculations

Achieving accurate profit and loss calculations can be challenging due to:

- Market Volatility: Volatility impacts options pricing, making it difficult to predict future movements accurately.

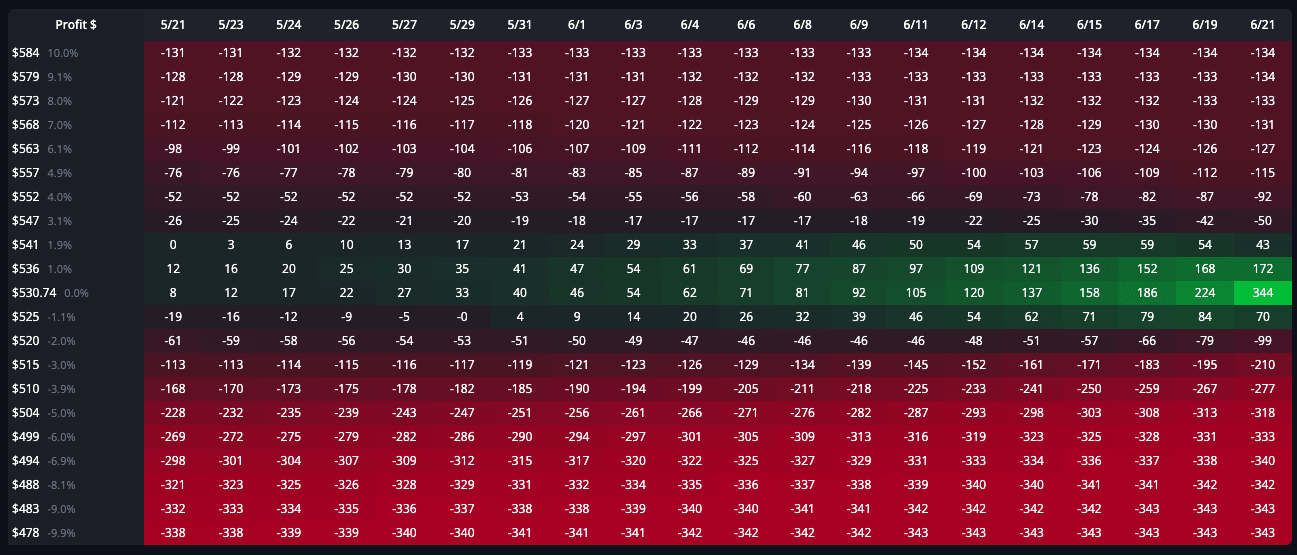

- Time Decay: Options lose value as they approach expiration; accounting for this decay is crucial.

- Complex Strategies: Strategies like spreads, straddles, and iron condors involve multiple legs, complicating calculations.

- Interest Rates: Changes in interest rates affect options pricing and need to be incorporated into calculations.

Using an Options Profit Calculator to Overcome Challenges

An options profit calculator helps overcome these challenges by providing:

- Scenario Analysis: Allows input of different variables to analyze multiple scenarios and understand how changes in market conditions affect outcomes.

- Sensitivity Analysis: Shows how factors like volatility, time decay, and interest rates impact options' value, helping traders adjust strategies.

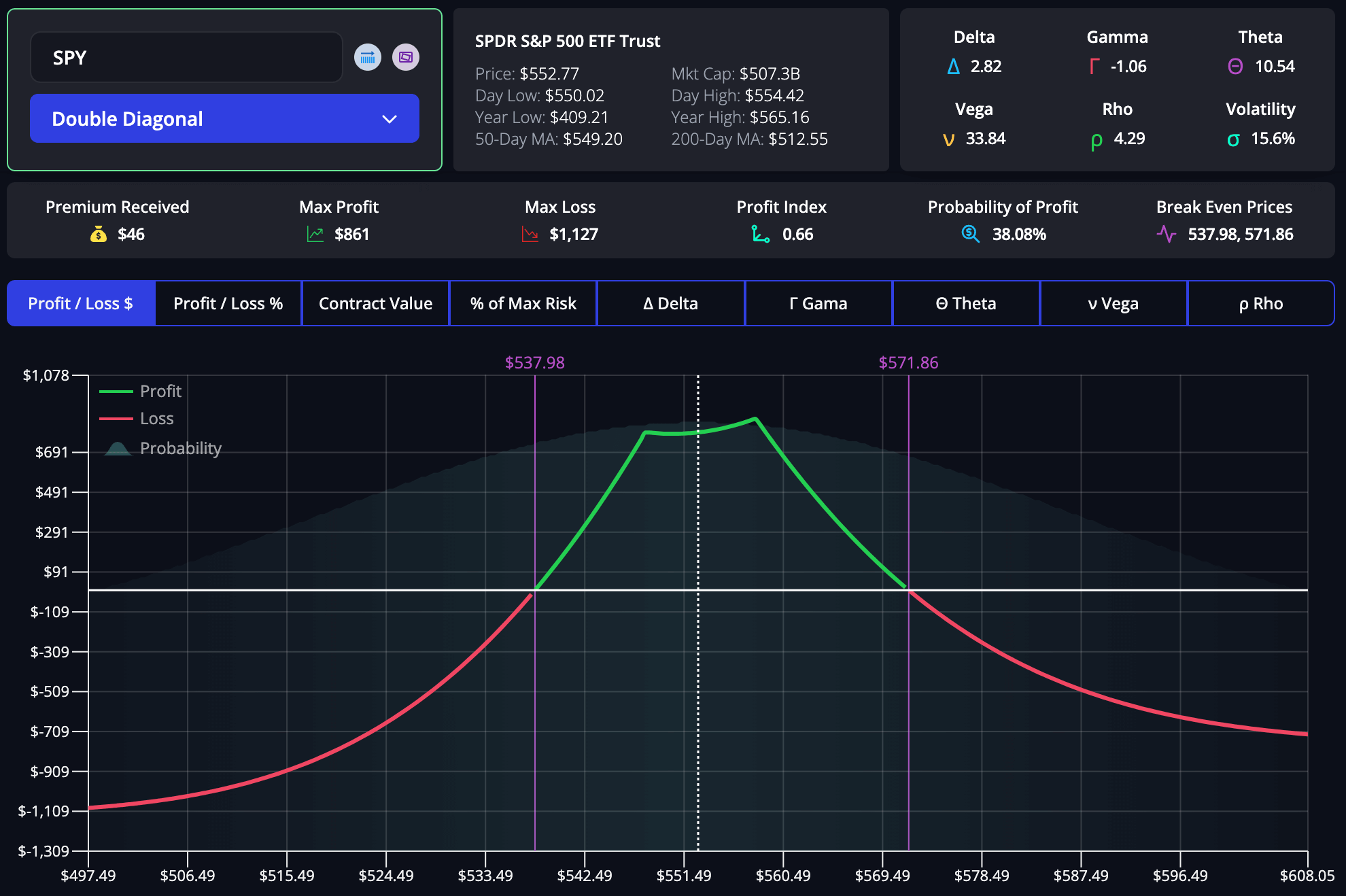

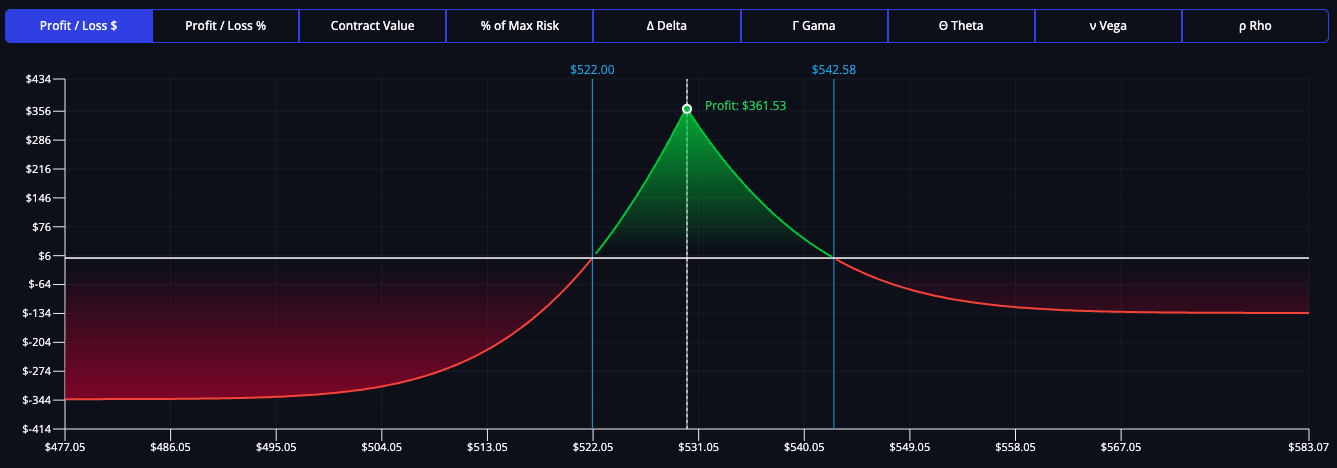

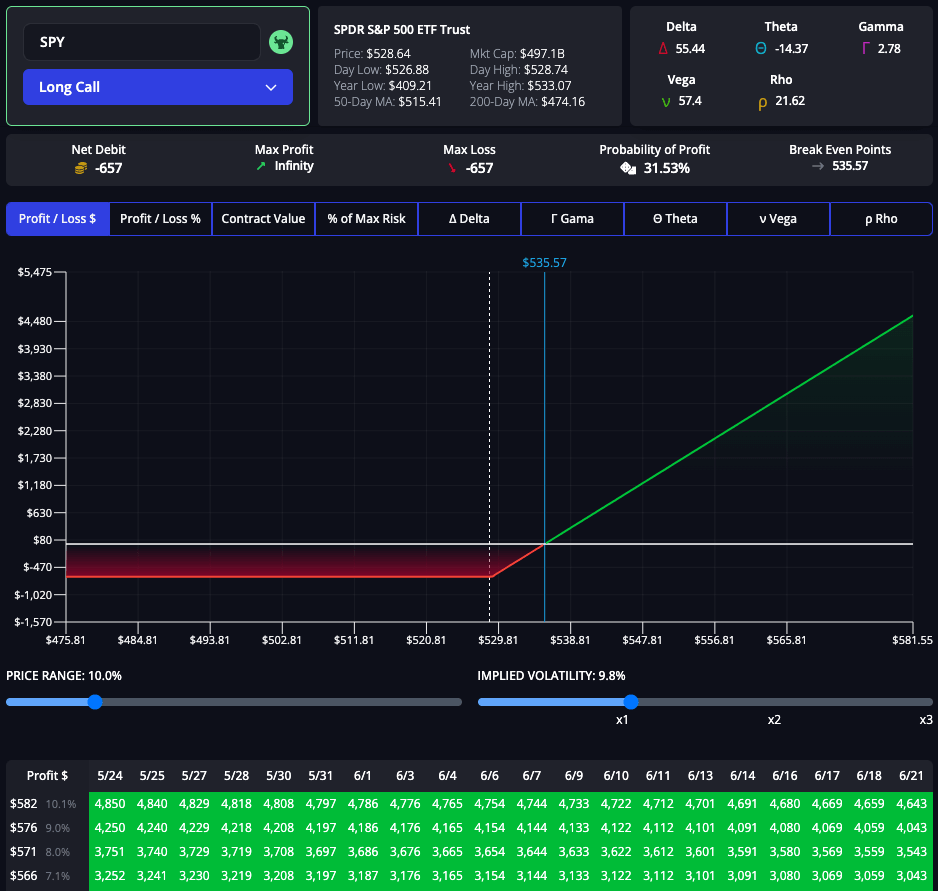

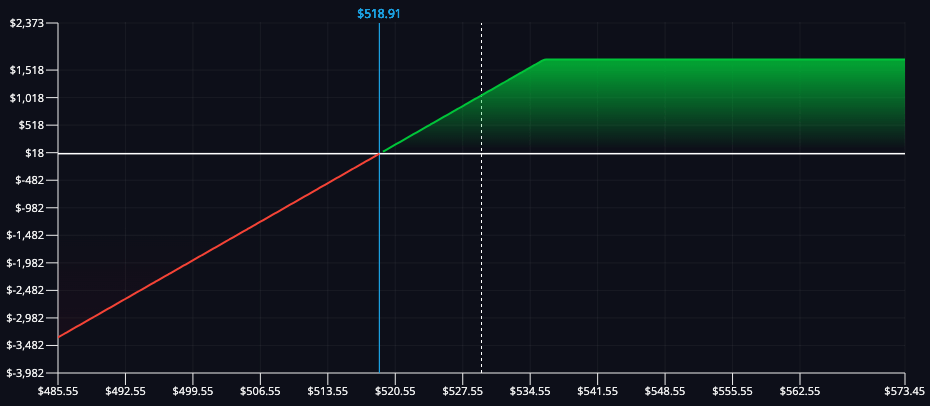

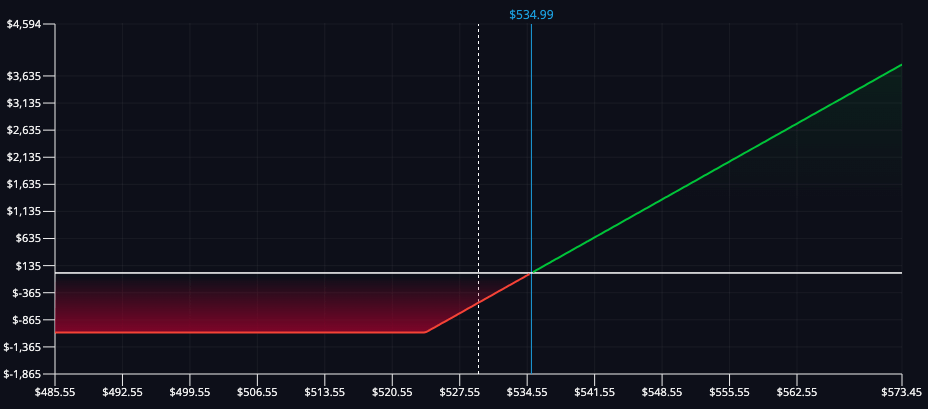

- Visual Representations: Includes graphs and payoff diagrams to visually represent potential profits and losses, making complex information easier to grasp.

- Real-Time Data: Uses real-time market data for up-to-date calculations, enhancing decision accuracy.

Practical Implications

For example, a trader evaluating a call option on a volatile stock can use an options profit calculator to input various volatility levels, strike prices, and expiration dates. This helps them see how these factors influence potential profits and losses, allowing them to select the most favorable parameters and make an informed decision, reducing the risk of unexpected outcomes.

In the next section, we will provide a step-by-step guide to using an options profit calculator, ensuring you have the foundation needed to start maximizing your trading profits. This will include detailed instructions on setting up the calculator and tips for accurate data input.

HIGH POTENTIAL TRADES SENT DIRECTLY TO YOUR INBOX

Add your email to receive our free daily newsletter. No spam, unsubscribe anytime.

How to Use an Options Profit Calculator

Using an options profit calculator can significantly enhance your trading decisions by providing detailed insights into potential profits and losses. Here’s a concise and comprehensive guide to setting up and using an Options Profit Calculator effectively, including tips for accurate data input and strategic planning.

Step-by-Step Guide to Using an Options Profit Calculator

1. Choose Your Calculator

- Selection: Start by selecting an options profit calculator that fits your needs. There are many online tools available, ranging from basic to advanced features. Consider factors like user interface, data accuracy, and customization options.

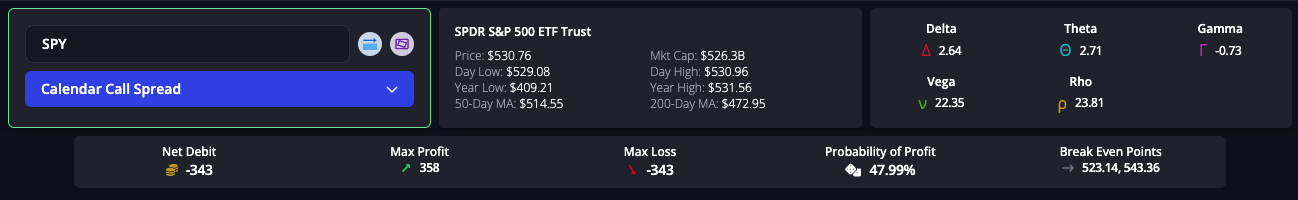

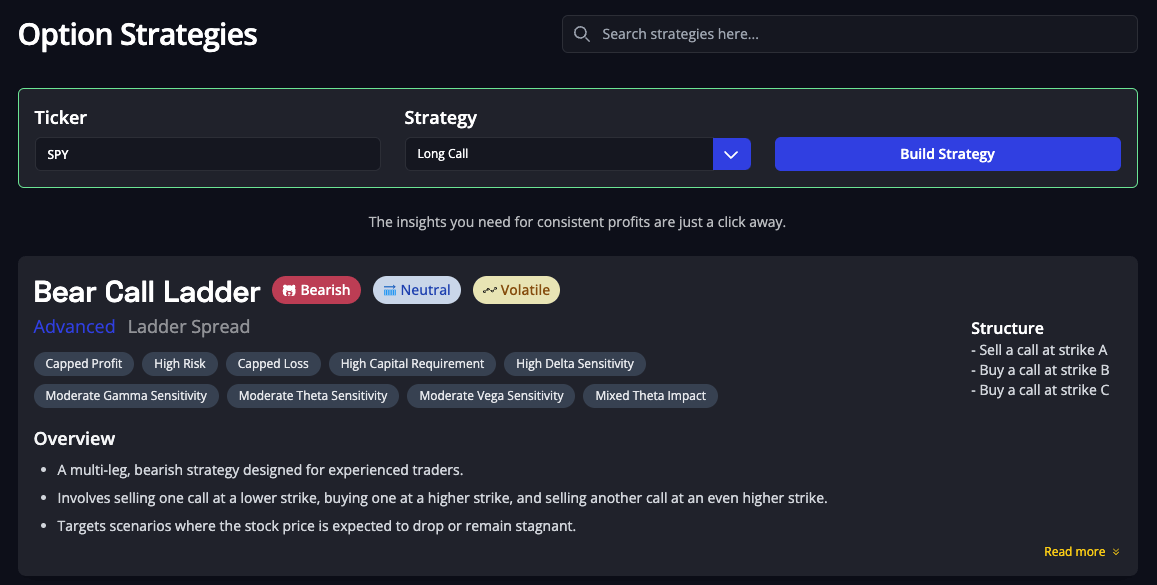

- Recommendation: The InsiderFinance Options Profit Calculator is highly recommended for its user-friendly interface and comprehensive analysis capabilities.

- Access: Navigate to the calculator's website or download the application. Sign up or log in if necessary.

2. Initial Setup and Input Details

- Select the Ticker: Enter the ticker symbol of the stock or asset you’re interested in. The calculator will automatically pull real-time data.

- Discover or Select a Strategy: Choose from a variety of pre-defined strategies such as covered calls, protective puts, or iron condors. The calculator provides templates for these strategies, which you can adjust based on your preferences.

- Adjust Inputs: Modify the parameters such as strike price, expiration date, and volatility to match your trading scenario. Real-time data updates ensure accuracy.

3. Analyze and Plan Your Trades

- Scenario Analysis: The calculator will display potential profit and loss scenarios based on your inputs. Use this to visualize different outcomes and refine your strategy.

- Sensitivity Analysis: Assess how changes in key variables like volatility and time decay impact your options. This helps in understanding the risks and potential rewards.

- Strategic Planning: Compare different trading strategies by adjusting the inputs and analyzing the outcomes. Evaluate the potential outcomes of a simple call option versus a more complex strategy like a straddle or spread.

4. Execute Trades

- Implementation: Once you’ve identified a favorable strategy, use the insights gained from the calculator to execute your trade. Ensure that all parameters align with your analysis to maximize your chances of success.

- Monitoring: Continue to monitor market conditions and reassess your position using the calculator. This helps you make necessary adjustments to optimize your trading outcomes.

Tips for Accurate Data Input

Accurate data input is crucial for reliable predictions. Here are some practical tips to ensure you enter data correctly:

- Double-Check Asset Prices: Ensure you’re using the latest market prices for the underlying asset. InsiderFinance's real-time data integration helps with this.

- Verify Strike Prices and Expiration Dates: Enter the correct strike price and expiration date for your options. Mistakes here can lead to incorrect profit and loss predictions.

- Update Volatility and Interest Rates: Keep these figures up-to-date based on the latest market conditions. Volatility and interest rates can fluctuate, impacting your trade’s potential outcomes.

- Be Consistent: Use consistent units and formats for all inputs to prevent errors and ensure the calculator functions correctly.

Using an options profit calculator involves a few straightforward steps that, when followed accurately, can significantly enhance your trading decisions. By inputting correct data, analyzing various scenarios, and refining your strategies, you gain valuable insights into the potential outcomes of your trades.

Leveraging the full potential of the InsiderFinance Options Profit Calculator can help you make informed decisions, optimize your trades, and ultimately enhance your profitability.

Examples of Successful Options Trading Strategies

Here are several examples of profitable trading strategies that have been effectively planned and executed using an options profit calculator. Each strategy includes detailed explanations, real-world case studies, and tips for optimal use.

Covered Call

- Primary Objective: Generate additional income from holding a stock.

- Best Suited Market Conditions: Mildly bullish markets where the stock is expected to rise slightly or stay flat.

- Scenario: You hold 100 shares of a stock trading at $50 and sell a call option with a strike price of $55, expiring in one month.

- Analysis: The calculator shows a maximum profit if the stock price reaches $55 at expiration, with limited downside risk since you own the underlying stock. The break-even point is slightly below $50 due to the premium received from selling the call.

- Outcome: The stock price reaches $54, the call option expires worthless, and you keep the premium, resulting in a profitable trade.

- Case Study: A trader holding Apple Inc. shares used the covered call strategy during a period of market stability, earning additional income through premiums while the stock price remained relatively flat.

Protective Put

- Primary Objective: Protect against potential losses in a long stock position.

- Best Suited Market Conditions: Bearish or uncertain markets where protection is needed against downside risk.

- Scenario: You buy a put option to hedge against potential losses on a stock currently trading at $70.

- Analysis: The calculator shows that the put option limits the maximum loss if the stock price drops significantly. You can see the potential outcomes at different stock prices, providing peace of mind knowing that your downside is protected.

- Outcome: The stock price drops to $60, but the put option offsets the losses, minimizing your overall loss.

- Case Study: During the 2008 financial crisis, many investors used protective puts on financial stocks to hedge against severe losses as the market plummeted.

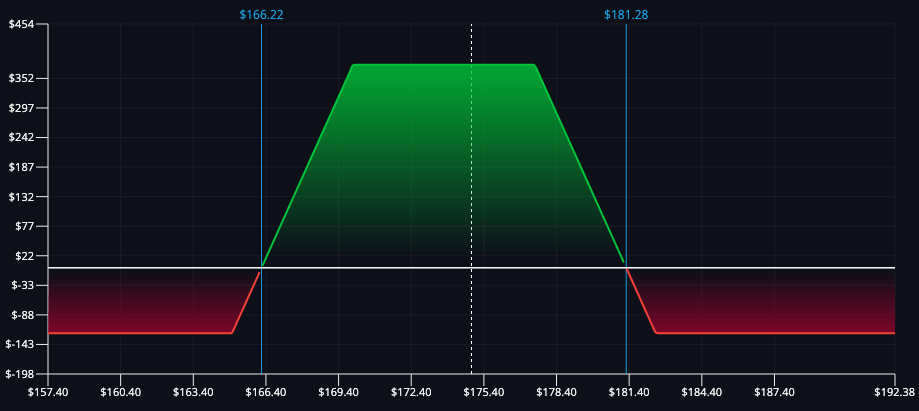

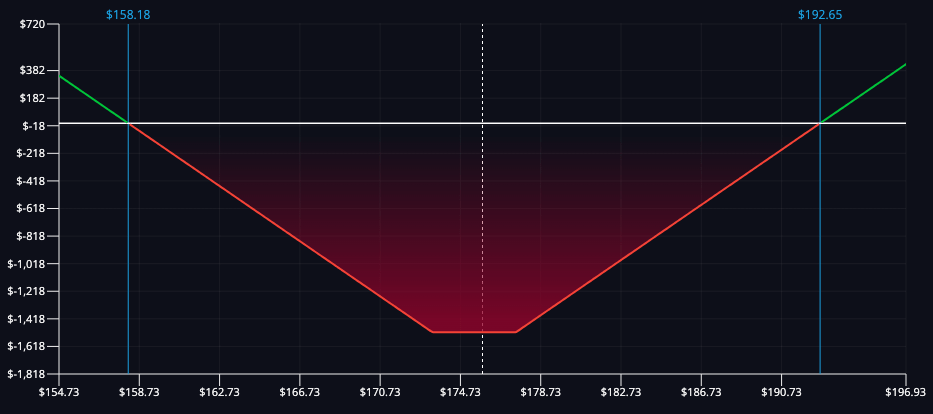

Iron Condor

- Primary Objective: Profit from low volatility when the stock price is expected to remain within a certain range.

- Best Suited Market Conditions: Stable markets with low volatility.

- Scenario: You execute an iron condor strategy by selling an out-of-the-money call and put while buying further out-of-the-money call and put options.

- Analysis: The calculator illustrates a profit zone between the strike prices of the sold options. The maximum profit occurs if the stock price remains within this range at expiration, while the risk is limited to the difference between the strike prices of the bought and sold options minus the net premium received.

- Outcome: The stock price remains stable within the profit zone, resulting in a successful trade with limited risk and decent profit.

- Case Study: A trader utilized an iron condor strategy on the S&P 500 index during a period of historically low volatility in 2017, profiting as the index remained range-bound.

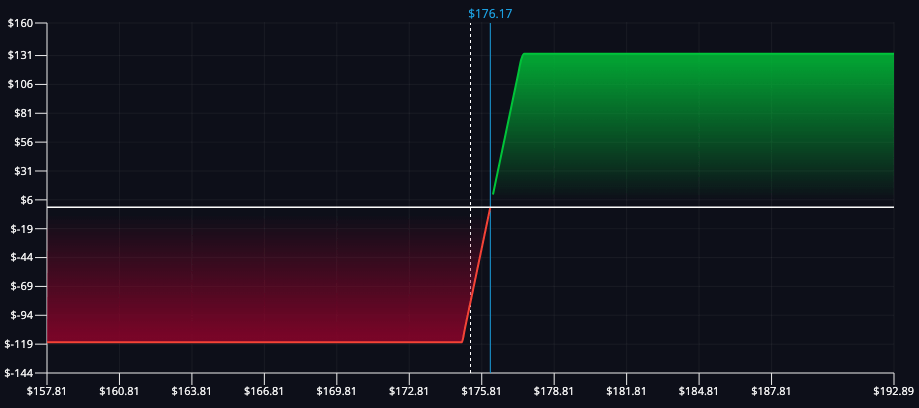

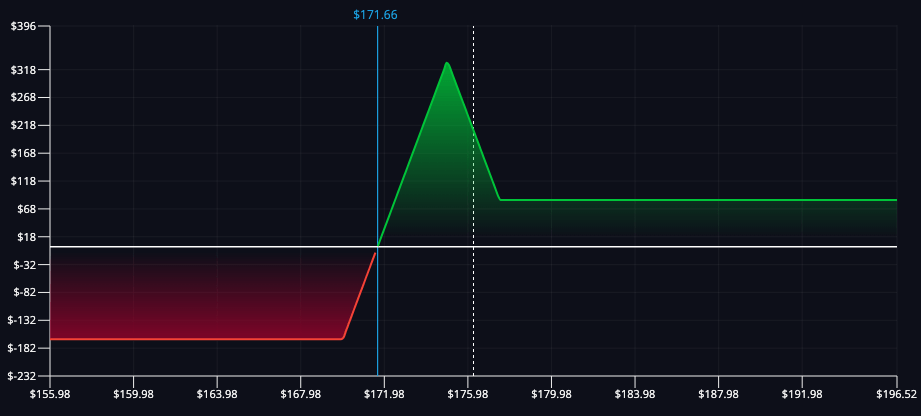

Bull Call Spread

- Primary Objective: Profit from a moderate rise in the stock price.

- Best Suited Market Conditions: Moderately bullish markets where the stock is expected to rise modestly.

- Scenario: You buy a call option with a lower strike price and sell another call option with a higher strike price, both expiring at the same time, on a stock trading at $50.

- Analysis: The calculator shows potential profits if the stock price rises but remains below the higher strike price. This strategy limits both potential gains and losses.

- Outcome: The stock price rises to $55, maximizing your profit due to the difference in premiums while keeping your risk contained.

- Case Study: During a steady uptrend in Microsoft shares, a trader executed a bull call spread and profited as the stock price increased moderately within the expected range.

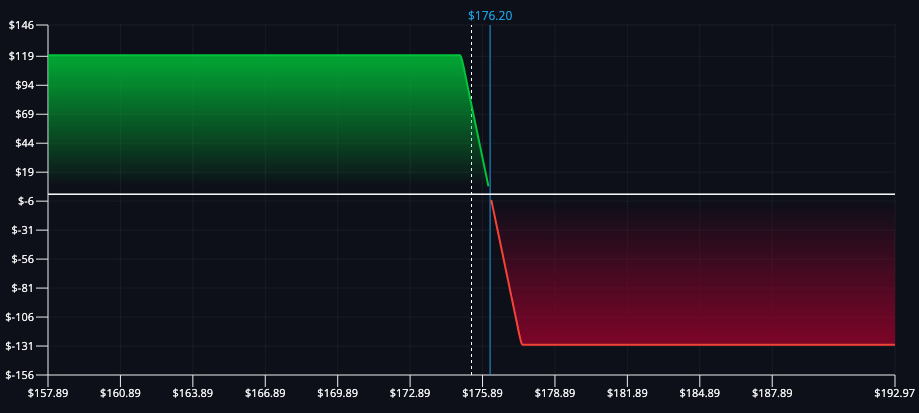

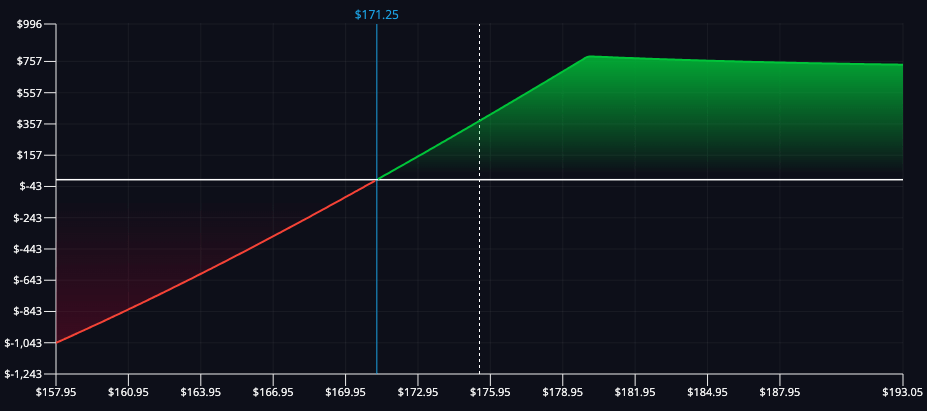

Bear Put Spread

- Primary Objective: Profit from a moderate decline in the stock price.

- Best Suited Market Conditions: Moderately bearish markets where the stock is expected to fall modestly.

- Scenario: You buy a put option with a higher strike price and sell another put option with a lower strike price, both expiring at the same time, on a stock trading at $70.

- Analysis: The calculator indicates potential profits if the stock price falls but remains above the lower strike price. This strategy provides a limited risk-reward profile.

- Outcome: The stock price drops to $65, yielding a profit due to the difference in premiums between the bought and sold put options.

- Case Study: A trader used a bear put spread on Tesla stock during a period of anticipated market correction, securing profits as the stock price declined modestly.

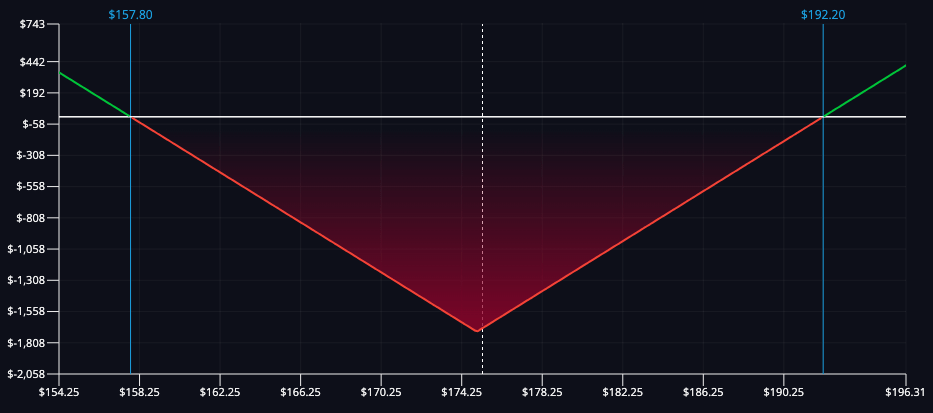

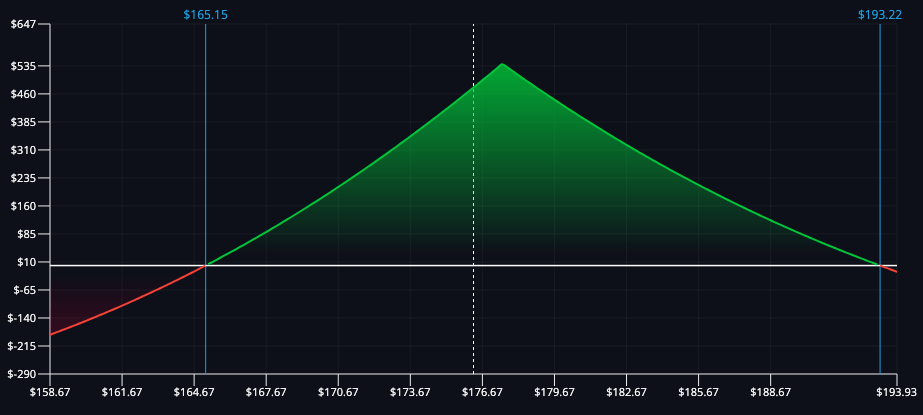

Straddle

- Primary Objective: Profit from significant price movement in either direction.

- Best Suited Market Conditions: High volatility markets where significant price movements are expected.

- Scenario: You buy a call option and a put option with the same strike price and expiration date on a stock trading at $100, anticipating high volatility.

- Analysis: The calculator shows potential profits if the stock price moves significantly in either direction. The risk is limited to the premiums paid for both options.

- Outcome: The stock price moves sharply to $120, yielding a significant profit from the call option, while the loss from the put option is limited to the premium paid.

- Case Study: Ahead of a major earnings report, a trader placed a straddle on Netflix, profiting as the stock surged dramatically post-announcement.

Strangle

- Primary Objective: Profit from significant price movement outside a range.

- Best Suited Market Conditions: High volatility markets where significant price movements are expected but the direction is uncertain.

- Scenario: You buy a call option with a higher strike price and a put option with a lower strike price, both expiring at the same time, on a stock trading at $100.

- Analysis: The calculator illustrates potential profits if the stock price moves significantly outside the range of the strike prices. This strategy is used when expecting high volatility but unsure of the direction.

- Outcome: The stock price drops to $80, resulting in a substantial profit from the put option, with the loss from the call option limited to the premium paid.

- Case Study: A trader used a strangle strategy on Amazon ahead of an anticipated volatile product launch event, benefiting from the significant price movement that followed.

Butterfly Spread

- Primary Objective: Profit from low volatility with minimal price movement.

- Best Suited Market Conditions: Stable markets with low expected price movement.

- Scenario: You buy one call option at a lower strike price, sell two call options at a middle strike price, and buy one call option at a higher strike price, all expiring at the same time, on a stock trading at $50.

- Analysis: The calculator shows limited risk and reward, with maximum profit achieved if the stock price is at the middle strike price at expiration.

- Outcome: The stock price settles at the middle strike price of $55, resulting in maximum profit due to the precise structure of the strategy.

- Case Study: During a period of low volatility, a trader used a butterfly spread on Coca-Cola shares, achieving maximum profit as the stock price remained within the expected range.

Calendar Spread

- Primary Objective: Profit from differences in time decay and volatility.

- Best Suited Market Conditions: Markets where short-term stability and long-term volatility are expected.

- Scenario: You sell a short-term call option and buy a longer-term call option with the same strike price on a stock trading at $100.

- Analysis: The calculator indicates potential profits if the stock price remains stable in the short term and becomes more volatile over the longer term. This strategy benefits from time decay.

- Outcome: The stock price remains around $100 as the short-term option expires, leading to profits from the longer-term option's value.

- Case Study: A trader executed a calendar spread on Google stock, capitalizing on short-term stability and long-term volatility during a product release cycle.

Diagonal Spread

- Primary Objective: Profit from gradual price movements over time.

- Best Suited Market Conditions: Gradual trending markets where slow but steady price movements are expected.

- Scenario: You buy a long-term call option with a lower strike price and sell a short-term call option with a higher strike price on a stock trading at $50.

- Analysis: The calculator shows potential profits if the stock price gradually rises. This strategy combines elements of vertical and horizontal spreads.

- Outcome: The stock price rises to $55, resulting in a profit due to the difference in premiums and the structure of the strategy.

- Case Study: A trader used a diagonal spread on Procter & Gamble shares during a steady uptrend, benefiting from the slow but consistent price increase.

By utilizing an options profit calculator to plan and execute these strategies, traders can enhance their chances of achieving profitable outcomes while managing risk effectively. These diverse strategies cater to different market conditions and trader objectives, showcasing the versatility of options trading.

Next, we'll explore common mistakes traders make with options profit calculators and provide actionable tips to avoid these pitfalls, ensuring better accuracy and results in your trading endeavors.

Maximizing Profits with Options Profit Calculators

Using an options profit calculator can significantly enhance your trading strategy, but avoiding common mistakes and implementing best practices is crucial for accurate results and optimal decision-making.

Data Input Accuracy

- Common Mistake: Entering incorrect data such as the underlying asset price, strike price, expiration date, or volatility.

- Best Practice: Double-check all inputs for accuracy. Use reliable sources for real-time data and verify all details before calculations.

- Real-World Scenario: A trader misentered the expiration date for an options trade, leading to incorrect profit and loss calculations. This resulted in a misinformed trade that ultimately led to a loss when the option expired sooner than expected.

Considering Market Conditions

- Common Mistake: Ignoring current market conditions, such as volatility spikes or economic announcements.

- Best Practice: Stay updated on market conditions and adjust your inputs accordingly. Ensure that the volatility and interest rates reflect the latest market data.

- Real-World Scenario: During a period of high market volatility, a trader failed to update the volatility parameter, leading to an underestimation of potential losses. This mistake caused significant unexpected losses when the market moved sharply against their position.

Balancing Tool Usage

- Common Mistake: Solely relying on the calculator without considering other market analysis.

- Best Practice: Use the calculator as one of several tools in your decision-making process. Complement it with other analytical tools and market research.

- Real-World Scenario: A trader relied exclusively on the options profit calculator without cross-referencing other market indicators. When the market took an unexpected turn, the trader faced substantial losses because they hadn't considered other influencing factors.

Interpreting Results

- Common Mistake: Misunderstanding payoff diagrams, Greeks, or sensitivity analyses.

- Best Practice: Invest time in learning how to interpret the results generated by the calculator. Familiarize yourself with key metrics and their implications.

- Real-World Scenario: A novice trader misread a payoff diagram, thinking they had a profitable position when, in reality, their break-even point was much higher. This resulted in holding a losing position longer than advisable.

Updating Parameters

- Common Mistake: Neglecting to update parameters like volatility and interest rates as market conditions and positions change.

- Best Practice: Regularly update the calculator parameters based on the latest market data and your evolving positions.

- Real-World Scenario: A trader using outdated interest rates and volatility figures continued to execute trades based on these incorrect assumptions. Over time, this led to a series of poorly timed trades and cumulative losses.

Understanding the Greeks

- Common Mistake: Ignoring the Greeks (Delta, Gamma, Theta, Vega, and Rho) which are crucial for understanding the sensitivity of your options.

- Best Practice: Pay close attention to the Greeks and understand how each one affects your options. Use this knowledge to manage risk and optimize your strategy.

- Real-World Scenario: A trader ignored the impact of Theta (time decay) on their long call options, assuming they could hold them until expiration without significant loss. As a result, they faced substantial losses as the options rapidly lost value in the final weeks before expiration.

Scenario Analysis

- Common Mistake: Not running multiple scenarios to see how different conditions affect your positions.

- Best Practice: Conduct scenario analysis to test various market conditions. This helps you prepare for different outcomes and adjust your strategies proactively.

- Real-World Scenario: Another trader relied solely on a single favorable scenario generated by the calculator without considering alternative outcomes. When the market took an unexpected turn, the trader was unprepared and faced substantial losses.

Using an options profit calculator effectively requires careful attention to detail, continuous learning, and strategic planning. By avoiding common mistakes, regularly updating your inputs, and leveraging multiple tools, you can enhance your trading decisions and maximize your profits.

Incorporating these best practices into your trading routine will help you navigate the complexities of options trading and achieve your financial goals.

Tools That Complement the Options Profit Calculator

While an options profit calculator is a powerful tool, integrating it with other resources can further enhance your trading strategy. In this section, we explore additional tools that complement the options profit calculator and provide valuable resources to stay updated on trading strategies and market trends.

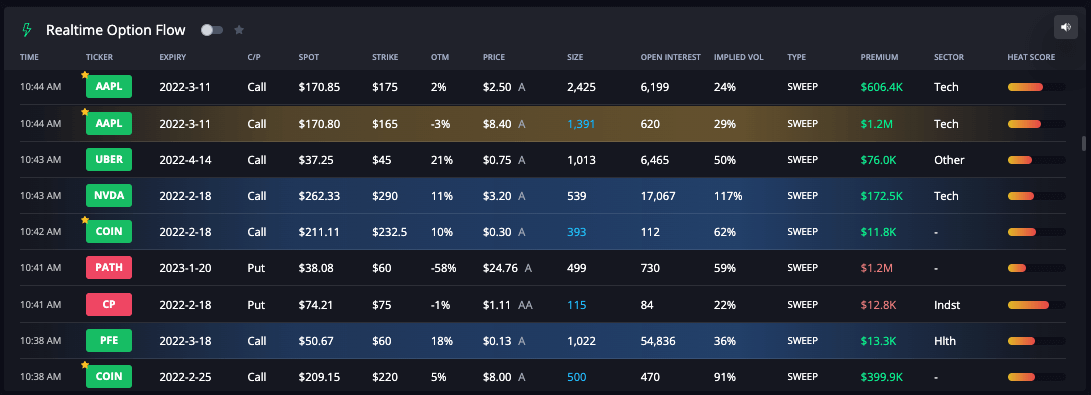

Options Flow Dashboards

- Overview: Tools like the InsiderFinance options flow dashboard offer real-time data on the options market, including large trades, unusual activity, and overall market sentiment.

- Benefits: These dashboards help identify trends and opportunities that might not be apparent through traditional analysis alone, allowing you to make more informed trading decisions.

Technical Analysis Software

- Examples: Charting tools such as TradingView or MetaTrader provide advanced technical analysis capabilities.

- Benefits: These tools allow you to apply various indicators and patterns to assess market conditions and predict future movements, which can be integrated with the insights from your options profit calculator.

Risk Management Platforms

- Examples: Platforms like Risk Navigator or other portfolio management software.

- Benefits: These tools help you assess and manage the risk of your overall portfolio, providing insights into how different positions interact and the potential impact of market changes.

Market News Aggregators

- Examples: Websites like Bloomberg, Reuters, and MarketWatch provide comprehensive news coverage and analysis.

- Benefits: Staying updated with the latest market news helps you anticipate market-moving events and adjust your strategies accordingly.

Volatility Analysis Tools

- Examples: Tools focusing on volatility, such as the Cboe Volatility Index (VIX) and volatility charting software.

- Benefits: These tools provide insights into market sentiment and expected price fluctuations, critical for options trading.

Education Platforms

- Examples: Websites and platforms like Investopedia, Udemy, Coursera, and InsiderFinance offer courses and tutorials on options trading.

- Benefits: Continuous learning helps you expand your knowledge and improve your trading skills, making better use of tools like the options profit calculator.

By leveraging these additional tools and resources, you can create a comprehensive and well-rounded trading strategy. Integrating the insights from an options profit calculator with real-time data, technical analysis, risk management, and continuous education ensures that you stay ahead in the dynamic world of options trading.

Enhance Your Trading with the InsiderFinance Options Profit Calculator

An options profit calculator is an indispensable tool for both novice and experienced traders. It allows you to simulate various trading scenarios, predict potential profits and losses, and make informed decisions based on accurate data. By understanding the impact of different market variables and trading strategies, you can optimize your trades and enhance your overall profitability.

Importance of Using an Options Profit Calculator

The key benefits of using an options profit calculator include:

- Accurate Predictions: Provides detailed scenarios of potential profits and losses, enabling you to anticipate market movements and plan accordingly.

- Strategic Planning: Helps in evaluating different strategies and their outcomes, allowing you to choose the most effective approach for your trading goals.

- Risk Management: Assists in understanding the risk-reward profile of your trades, helping you manage risk more effectively and avoid significant losses.

- Informed Decisions: Enables traders to make decisions based on comprehensive data analysis, reducing the likelihood of making costly mistakes.

Start Using the InsiderFinance Options Profit Calculator Today to Boost Your Trading Success

Ready to take your options trading to the next level? Start using the InsiderFinance Options Profit Calculator today. With its user-friendly interface, accurate data, and comprehensive analysis tools, it’s designed to help you make better-informed trading decisions and maximize your profits.

Successful trading is a journey that requires continuous learning, strategic planning, and effective risk management. By leveraging the right tools and resources, such as the InsiderFinance Options Profit Calculator, you can navigate the complexities of options trading and achieve your financial goals.

HIGH POTENTIAL TRADES SENT DIRECTLY TO YOUR INBOX

Add your email to receive our free daily newsletter. No spam, unsubscribe anytime.

FAQs

What is an options profit calculator and how does it work?

An options profit calculator is a tool that helps traders predict potential profits and losses from options trades by simulating different market scenarios. By inputting parameters such as the underlying asset price, strike price, expiration date, and volatility, the calculator provides detailed analyses, including profit/loss graphs, payoff diagrams, and sensitivity analyses, to help traders make informed decisions.

Why is accurate profit calculation important in options trading?

Accurate profit calculation is crucial in options trading because it helps traders assess the viability of their strategies, manage risks, and set realistic expectations. Without precise calculations, traders might make decisions based on flawed assumptions, leading to unexpected losses and missed opportunities.

How do I set up an options profit calculator?

Setting up an options profit calculator involves choosing a reliable tool, entering basic information like the underlying asset price, strike price, expiration date, and volatility, and then analyzing the generated results. Regularly updating these parameters and using the insights to refine your strategies are key steps in effective setup and usage.

Can an options profit calculator help with risk management?

Yes, an options profit calculator is a valuable risk management tool. It allows traders to assess the risk-reward profile of their trades, understand the impact of market changes, and plan strategies that align with their risk tolerance. By providing detailed analyses, the calculator helps traders make more informed decisions and manage risks effectively.

What are some common mistakes to avoid when using an options profit calculator?

Common mistakes include entering incorrect data, ignoring market conditions, over-relying on the calculator without additional market analysis, misinterpreting results, neglecting to update parameters, and underestimating time decay. Avoiding these mistakes requires attention to detail, continuous learning, and using complementary analytical tools.

How can I improve my trading strategy using the insights from an options profit calculator?

To improve your trading strategy, use the calculator to evaluate past trades, adjust entry and exit points, optimize strike prices and expiration dates, conduct scenario analyses, and regularly update your strategy based on new insights. Integrating the calculator with other tools and staying informed about market trends are also important steps.

Are there any additional tools that can enhance my options trading strategy?

Yes, tools such as options flow dashboards, technical analysis software, risk management platforms, market news aggregators, and volatility analysis tools can complement your options profit calculator. These tools provide real-time data, advanced analytics, and comprehensive insights to help you make more informed trading decisions.

What resources are available for learning more about options trading?

There are numerous resources available, including financial news websites, trading forums, social media channels of market experts, podcasts, webinars, market analysis reports, and economic calendars. Additionally, books, articles, and online courses offer in-depth knowledge and strategies for options trading.

How often should I update the parameters in my options profit calculator?

You should regularly update the parameters in your options profit calculator to reflect the latest market conditions. This includes adjusting for changes in the underlying asset price, volatility, interest rates, and other relevant factors. Regular updates ensure your calculations remain accurate and relevant.

What are some advanced options trading strategies I can explore?

Advanced options trading strategies include straddles, strangles, iron condors, butterflies, and bull call spreads (vertical spreads). Each strategy has unique risk-reward profiles and is suitable for different market conditions. Using an options profit calculator can help you understand and implement these strategies effectively.