Best Options Strategies to Generate Premium Income

Key Takeaways

- Learn how to generate premium income with options strategies.

- Discover popular strategies like covered calls and cash-secured puts.

- Understand advanced strategies like iron condors and credit spreads.

- Utilize an options profit calculator for accurate, real-time analysis.

Why It Matters

- Generate premium income with effective options strategies.

- Minimize risks with detailed strategy analysis and optimization.

- Leverage real-time data and automated inputs for informed decisions.

- Enhance trading outcomes with an options profit calculator.

Ever wondered how top traders consistently generate premium income? Discover the strategies that make it possible!

Options trading can be a lucrative way to generate premium income, but it requires a solid understanding of various strategies and tools. An options profit calculator is an essential tool for traders to evaluate potential profits and make informed decisions.

In this guide, we will explore different options strategies and demonstrate how the InsiderFinance Options Profit Calculator, with its superior accuracy and user experience, can help you maximize your income.

Understanding Options Premium

Options premium is the price that traders pay to buy or sell options contracts. It represents the income that options sellers receive.

Several factors influence options premium, including implied volatility, time decay, and the underlying asset price. Understanding these factors helps traders optimize their strategies and manage risk effectively.

Implied Volatility

Implied volatility (IV) measures the market's expectation of future volatility. Higher implied volatility typically increases the options premium because it indicates a greater potential for price movement.

For example, during periods of market uncertainty or significant events, IV tends to rise, leading to higher premiums.

Example:

- Current stock price: $100

- Strike price: $105

- Expiration date: 30 days

- Scenario 1: Low IV (20%)

- Calculated premium: $2.00

- Scenario 2: High IV (40%)

- Calculated premium: $4.50

In this example, the options premium is more than double in the high IV scenario compared to the low IV scenario, demonstrating the significant impact of implied volatility.

Time Decay

Time decay, or theta, represents the reduction in the value of an options premium as the expiration date approaches. Options are wasting assets, meaning their value decreases over time. The rate of time decay accelerates as the expiration date nears, which can significantly impact the profitability of an options strategy.

Example:

- Current stock price: $100

- Strike price: $105

- Implied volatility: 30%

- Scenario 1: 60 days to expiration

- Calculated premium: $5.00

- Scenario 2: 30 days to expiration

- Calculated premium: $3.00

Here, the options premium decreases by $2.00 as the time to expiration halves, highlighting the effect of time decay.

Underlying Asset Price

The price of the underlying asset is a fundamental factor that affects the options premium. For call options, the premium increases when the asset price rises, while for put options, the premium increases when the asset price falls.

Example:

- Strike price: $100

- Expiration date: 30 days

- Implied volatility: 25%

- Scenario 1: Underlying asset price at $95

- Calculated call option premium: $1.50

- Calculated put option premium: $6.00

- Scenario 2: Underlying asset price at $105

- Calculated call option premium: $6.00

- Calculated put option premium: $1.50

In this scenario, the call option premium increases and the put option premium decreases as the underlying asset price rises, demonstrating their inverse relationship.

Next, we will explore popular options strategies for generating premium income, starting with covered calls and cash-secured puts.

HIGH POTENTIAL TRADES SENT DIRECTLY TO YOUR INBOX

Add your email to receive our free daily newsletter. No spam, unsubscribe anytime.

Popular Options Strategies for Premium Income

Generating premium income through options strategies like covered calls and cash-secured puts is a popular approach among traders looking to enhance their returns.

Covered Call

A covered call strategy involves owning the underlying asset and selling call options on that asset to generate additional income. This strategy is straightforward and effective for traders who already hold the asset and wish to earn extra income from their holdings.

Pros:

- Generates additional income from owned assets.

- Provides a partial hedge against downside risk.

- Allows for profit from both the premium and potential capital gains.

Cons:

- Caps the potential upside gain if the stock price rises significantly.

- Requires ownership of the underlying asset, which involves capital investment.

- The stock may be called away if the price exceeds the strike price.

Market Conditions:

- Bull Markets: Covered calls can still generate income, but the potential for gains is capped. Selling calls with higher strike prices may be beneficial to allow for some upside.

- Bear Markets: This strategy provides some downside protection through the premium received, but the stock's decline can lead to overall losses.

- Low Volatility: Covered calls are ideal in low volatility environments as the stock price is less likely to move significantly, ensuring the premium is retained.

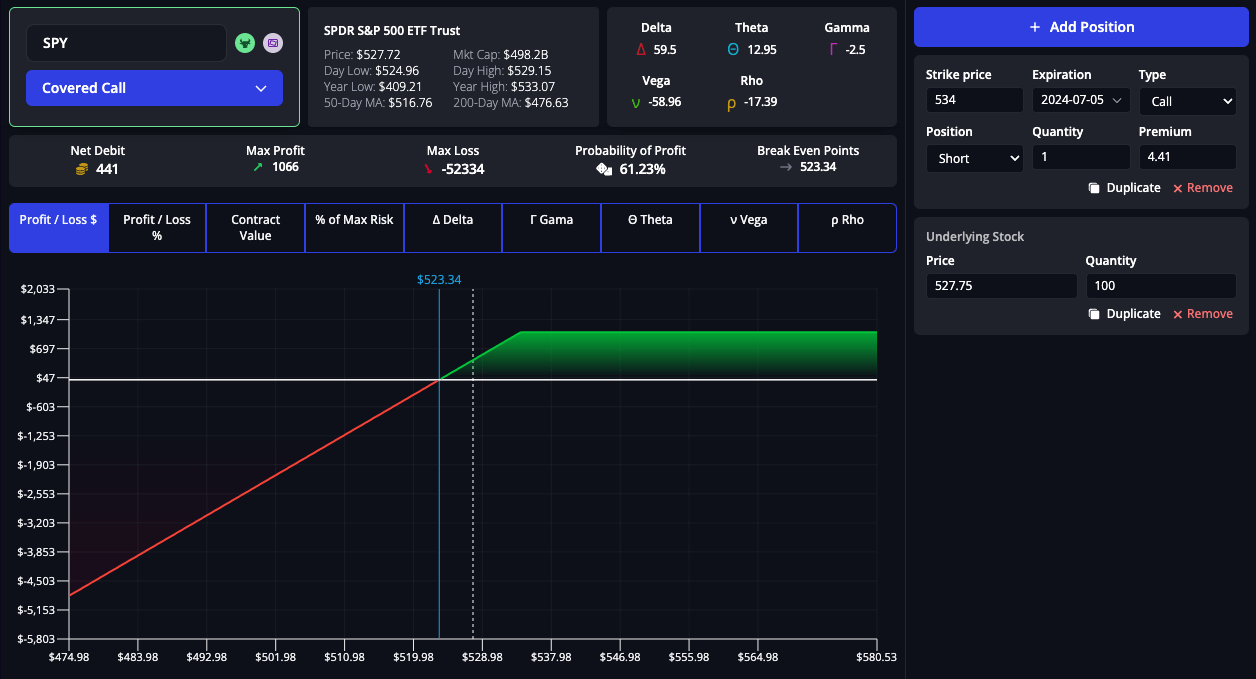

Real-World Example: SPY Covered Call Strategy

To illustrate how a covered call strategy works in practice, let's consider a trader using this strategy on SPY (the S&P 500 ETF).

SPY Strategy Details:

- SPY Price: $527.72

- SPY Shares Owned: 100

- Capital Required: $52,772 (100 SPY shares at $527.72)

Option Legs:

- $534 Short Call with 30-day Expiration

Options Profit Calculator Analysis:

- Premium Received: $441

- Max Profit: $1,066

- Max Loss: -$52,334

- Probability of Profit: 61.23%

- Breakeven Price: $523.34

Decision-Making Process:

- Objective: Generate additional income from owned SPY shares while potentially benefiting from a moderate increase in the ETF price.

- Analysis Using the InsiderFinance Options Profit Calculator: The trader chooses the ticker and desired options strategy. The tool shows that the maximum profit would be $1,066 ($441 premium + $625 capital gain if SPY hits $534) and the break-even price would be $523.34 ($527.72 current price - $4.41 premium).

- Outcome: The SPY price remains below $534 at expiration, allowing the trader to keep the premium without selling the shares, effectively generating significant income while retaining ownership of the asset.

Key Takeaways:

- The calculator's real-time data and automated inputs provided clear insights into potential outcomes, helping the trader make an informed decision.

- The covered call strategy effectively generated additional income while managing risk.

Variation: Poor Man’s Covered Call

A Poor Man’s Covered Call is a variation that uses long-term call options (LEAPS) instead of owning the underlying asset. This strategy requires less capital while still generating premium income.

Pros:

- Requires significantly less capital than traditional covered calls.

- Generates premium income with lower initial investment.

- Retains exposure to potential upside in the underlying asset.

Cons:

- Still limited upside if the stock price rises significantly.

- LEAPS options can be less liquid than owning the underlying asset.

- Potential for significant loss if the stock price falls below the LEAPS strike price.

Market Conditions:

- Bull Markets: This strategy can benefit from rising prices, but the upside is still capped. Ensure the LEAPS and short call strikes are set to allow for some price appreciation.

- Bear Markets: Less effective in declining markets as the LEAPS value can drop significantly. Premium income provides some offset.

- Low Volatility: Works well in stable environments where the underlying asset price does not fluctuate dramatically, preserving the value of the LEAPS and premium income.

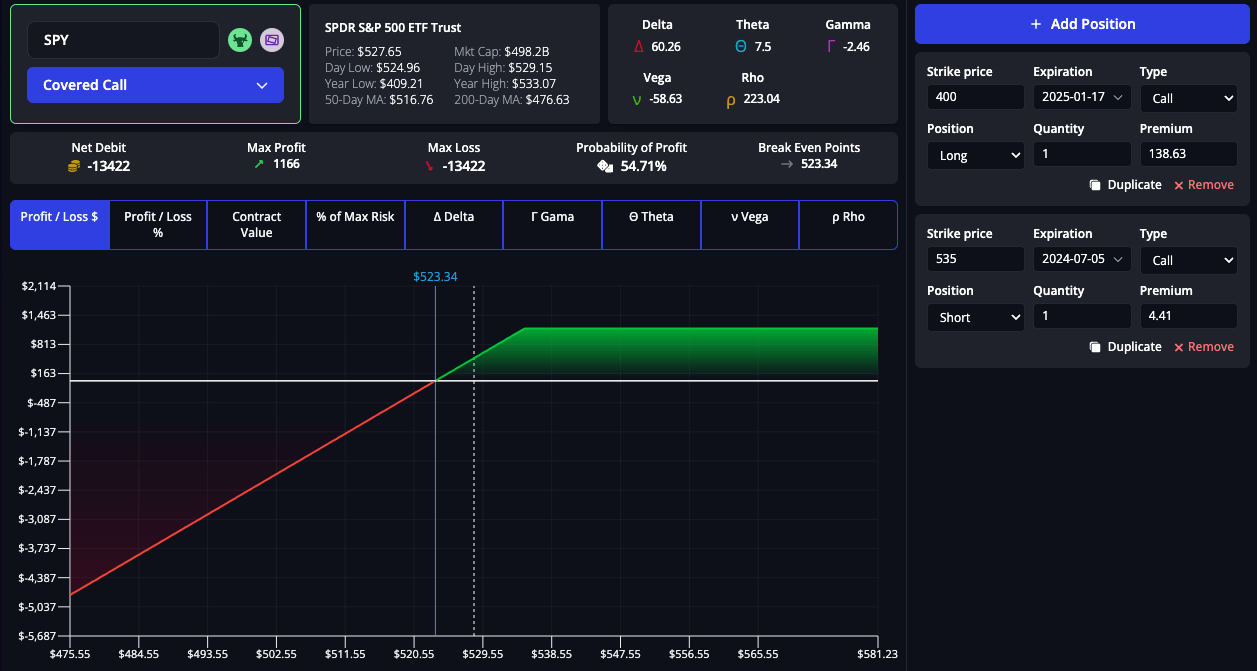

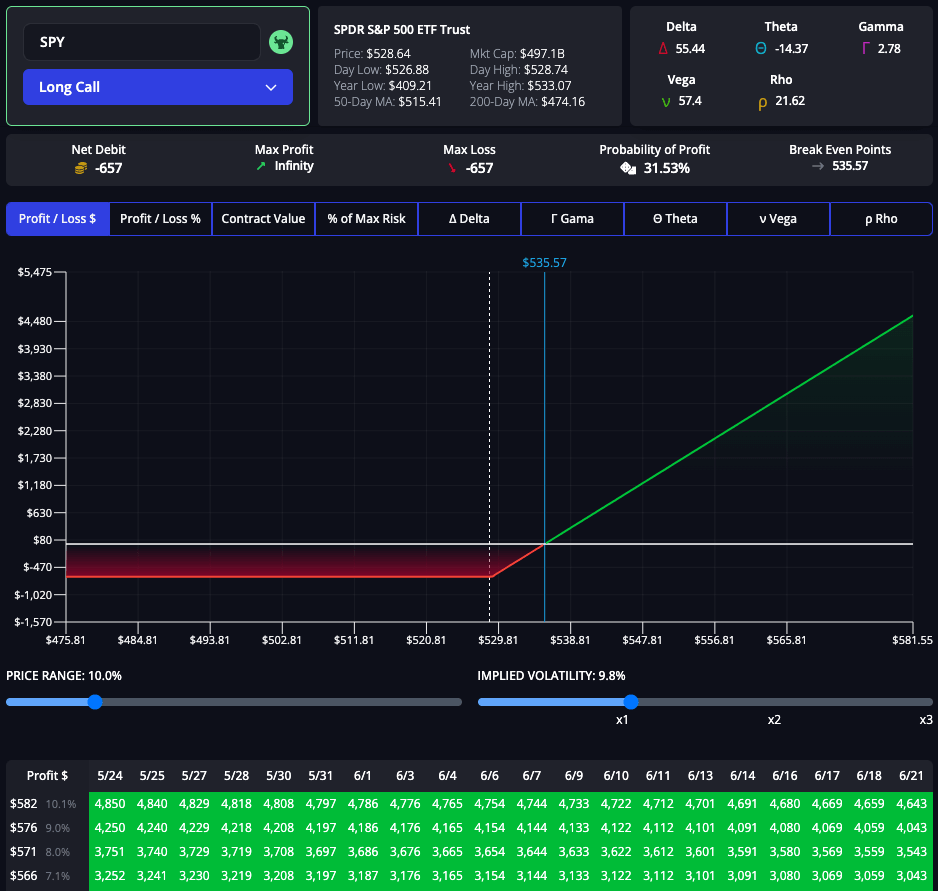

Real-World Example: SPY Poor Man’s Covered Call Strategy

To illustrate how a Poor Man’s Covered Call strategy works in practice, let's consider a trader using this strategy on SPY (the S&P 500 ETF).

SPY Strategy Details:

- SPY Price: $527.65

- SPY Shares Owned: 0

- Capital Required: Premium paid

Option Legs:

- $535 Short Call with 30-day Expiration

- $400 Long Call with 18-month Expiration

Options Profit Calculator Analysis:

- Premium Paid: $13,422

- Max Profit: $1,166

- Max Loss: -$13,422

- Probability of Profit: 54.71%

- Breakeven Price: $523.34

Decision-Making Process:

- Objective: Generate premium income with a lower initial investment while retaining potential upside exposure to SPY.

- Analysis Using the InsiderFinance Options Profit Calculator: The trader chooses the ticker and desired options strategy. The tool shows that the maximum profit would be $1,166, and the break-even price would be $523.34.

- Outcome: The SPY price remains below $535 at expiration, allowing the trader to keep the premium from the short call while holding the long call, effectively generating income with lower capital investment.

Key Takeaways:

- The calculator's real-time data and automated inputs provided clear insights into potential outcomes, helping the trader make an informed decision.

- The Poor Man’s Covered Call strategy effectively generated premium income with lower initial investment, while managing risk and retaining upside potential.

Cash-Secured Put

A cash-secured put strategy involves selling put options while setting aside enough cash to purchase the underlying asset if necessary. This strategy is used to generate income while potentially acquiring the asset at a lower price.

Pros:

- Generates income from the premium received.

- Provides an opportunity to buy the stock at a lower price.

- Limits potential loss to the cash reserved for the stock purchase.

Cons:

- Requires sufficient cash to cover the potential purchase.

- Limits upside gain to the premium received.

- The stock may be assigned if the price falls below the strike price.

Market Conditions:

- Bull Markets: Effective as it generates income and the likelihood of assignment is lower. Puts sold at lower strike prices can capitalize on rising markets.

- Bear Markets: Riskier due to higher chances of assignment. Selling puts at conservative strike prices can mitigate some risks.

- Low Volatility: Suitable in stable environments where the risk of significant price drops is lower, ensuring the premium is retained without assignment.

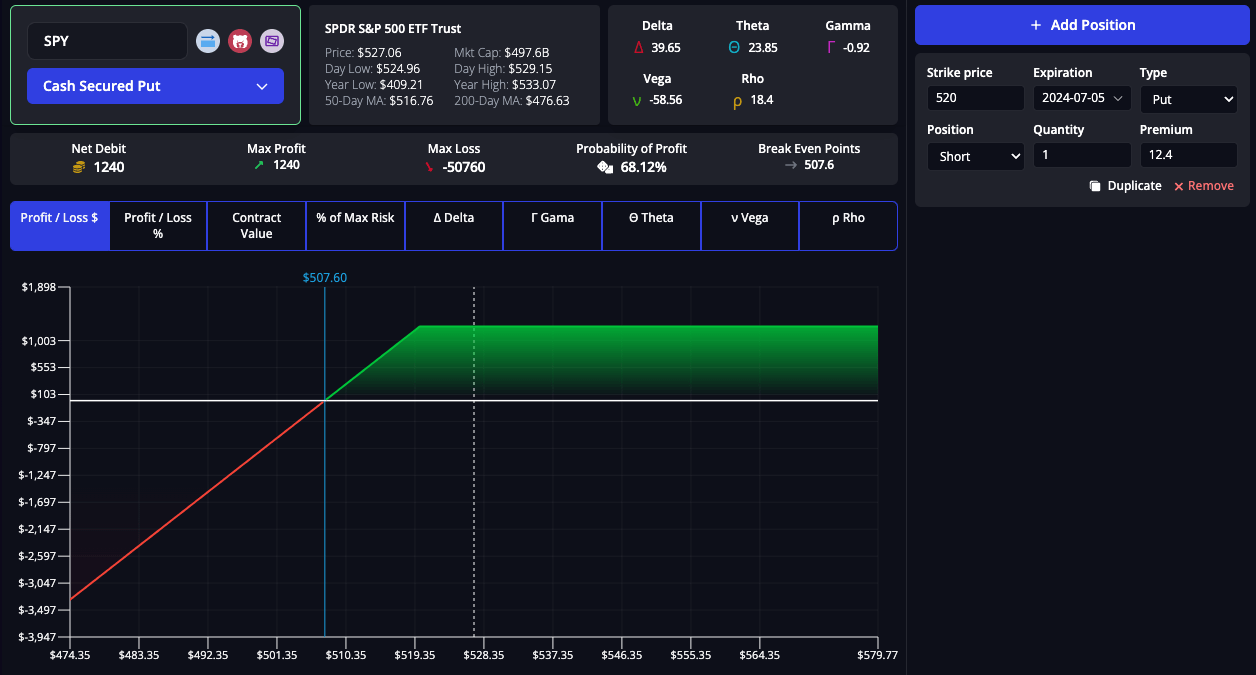

Real-World Example: SPY Cash-Secured Put Strategy

To illustrate how a cash-secured put strategy works in practice, let's consider a trader using this strategy on SPY (the S&P 500 ETF).

SPY Strategy Details:

- SPY Price: $527.06

- SPY Shares Owned: 0

- Cash Held: $52,000

- Capital Required: Stock purchase at strike, if necessary

Option Legs:

- $520 Short Put with 30-day Expiration

Options Profit Calculator Analysis:

- Premium Received: $1,240

- Max Profit: $1,240

- Max Loss: -$50,760

- Probability of Profit: 68.12%

- Breakeven Price: $507.60

Decision-Making Process:

- Objective: Generate income from the premium received while potentially acquiring SPY shares at a lower price.

- Analysis Using the InsiderFinance Options Profit Calculator: The trader chooses the ticker and desired options strategy. The tool shows that the maximum profit would be $1,240 and the break-even price would be $507.60.

- Outcome: If the SPY price remains above $520 at expiration, the trader keeps the premium without having to purchase the shares. If the price falls below $520, the trader will buy the shares at the strike price, effectively acquiring them at a discount.

Key Takeaways:

- The calculator's real-time data and automated inputs provided clear insights into potential outcomes, helping the trader make an informed decision.

- The cash-secured put strategy effectively generated premium income while providing an opportunity to acquire the asset at a lower price.

Variation: Naked Put

A Naked Put strategy (or short put strategy) involves selling put options without setting aside the cash to purchase the underlying asset. This is a riskier strategy used to generate income when the trader is confident the stock price will not fall below the strike price.

Pros:

- Generates income from the premium received.

- Requires less capital than cash-secured puts since no cash is set aside.

- Allows for greater leverage in a portfolio.

Cons:

- Higher risk if the stock price falls significantly.

- Potential for substantial losses if the stock is assigned and falls below the strike price.

- Margin requirements must be met, which can vary by broker.

Market Conditions:

- Bull Markets: Effective due to the lower likelihood of the stock price falling below the strike price, reducing the risk of assignment.

- Bear Markets: Risky as the stock price is more likely to fall, increasing the chances of significant losses.

- Low Volatility: Suitable when the market is stable, as the risk of sharp declines is minimized, ensuring the premium is retained.

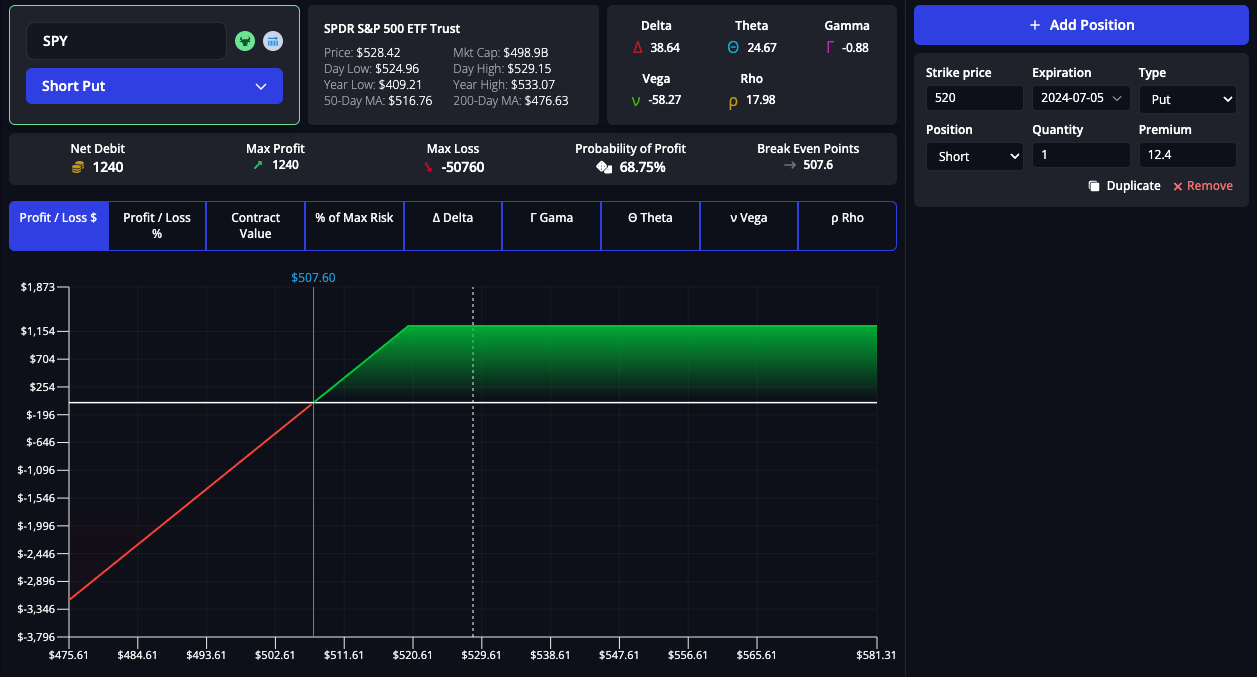

Real-World Example: SPY Naked Put Strategy

To illustrate how a Naked Put strategy works in practice, let's consider a trader using this strategy on SPY (the S&P 500 ETF).

SPY Strategy Details:

- SPY Price: $528.42

- SPY Shares Owned: 0

- Cash Held: $0

- Capital Required: Margin requirements and max loss

Option Legs:

- $520 Short Put with 30-day Expiration

Options Profit Calculator Analysis:

- Premium Received: $1,240

- Max Profit: $1,240

- Max Loss: -$50,760

- Probability of Profit: 68.75%

- Breakeven Price: $507.60

Decision-Making Process:

- Objective: Generate income from the premium received while leveraging margin to maximize returns.

- Analysis Using the InsiderFinance Options Profit Calculator: The trader chooses the ticker and desired options strategy. The tool shows that the maximum profit would be $1,240, and the break-even price would be $507.60.

- Outcome: If the SPY price remains above $520 at expiration, the trader keeps the premium without having to purchase the shares. If the price falls below $520, the trader will face substantial losses and be required to meet margin requirements.

Key Takeaways:

- The calculator's real-time data and automated inputs provided clear insights into potential outcomes, helping the trader make an informed decision.

- The Naked Put strategy effectively generated premium income, but with higher risks due to the lack of cash set aside for potential purchases.

Next, we will explore advanced options strategies such as iron condors and credit spreads, providing deeper insights into maximizing premium income.

Advanced Options Strategies

For traders seeking to further optimize their premium income, advanced options strategies like iron condors and credit spreads offer sophisticated methods to capture profits.

Iron Condors

An iron condor is an advanced options strategy that involves selling a call spread and a put spread simultaneously. This strategy benefits from low volatility and is designed to profit when the underlying asset remains within a specific price range.

Pros:

- Generates income from both the call and put spreads.

- Limited risk due to the purchase of further OTM options.

- Benefits from low volatility and a stable underlying asset price.

Cons:

- Limited profit potential.

- Requires precise strike price selection and monitoring.

- Losses occur if the underlying asset price moves significantly.

Market Conditions:

- Bull Markets: Less effective as prices may trend upwards beyond the range. Adjust strike prices to account for potential gains.

- Bear Markets: Similarly less effective if prices trend downwards beyond the range. Set conservative strikes to manage risks.

- Low Volatility: Ideal environment as prices are more likely to stay within the defined range, maximizing the chance of retaining the full premium.

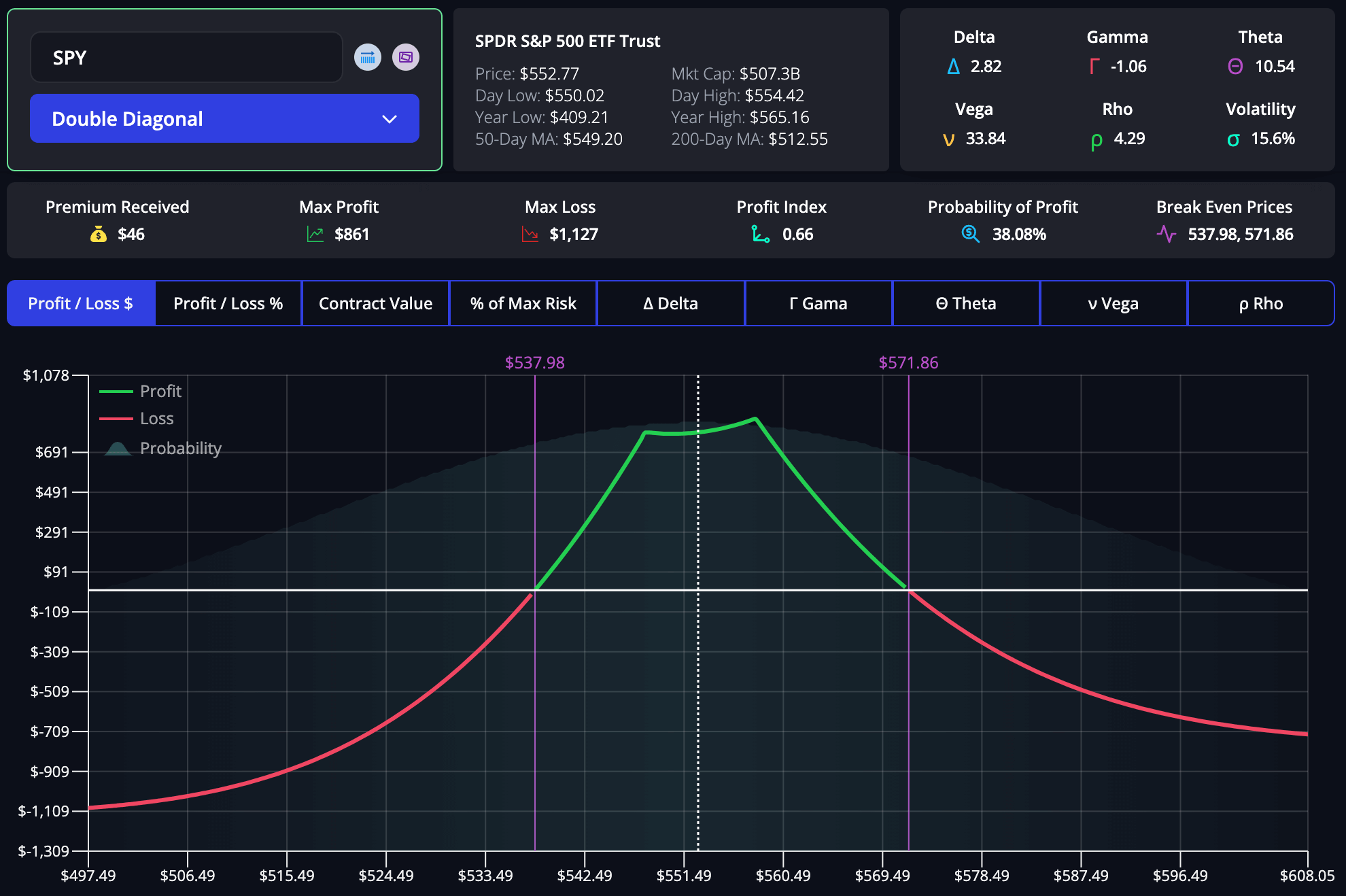

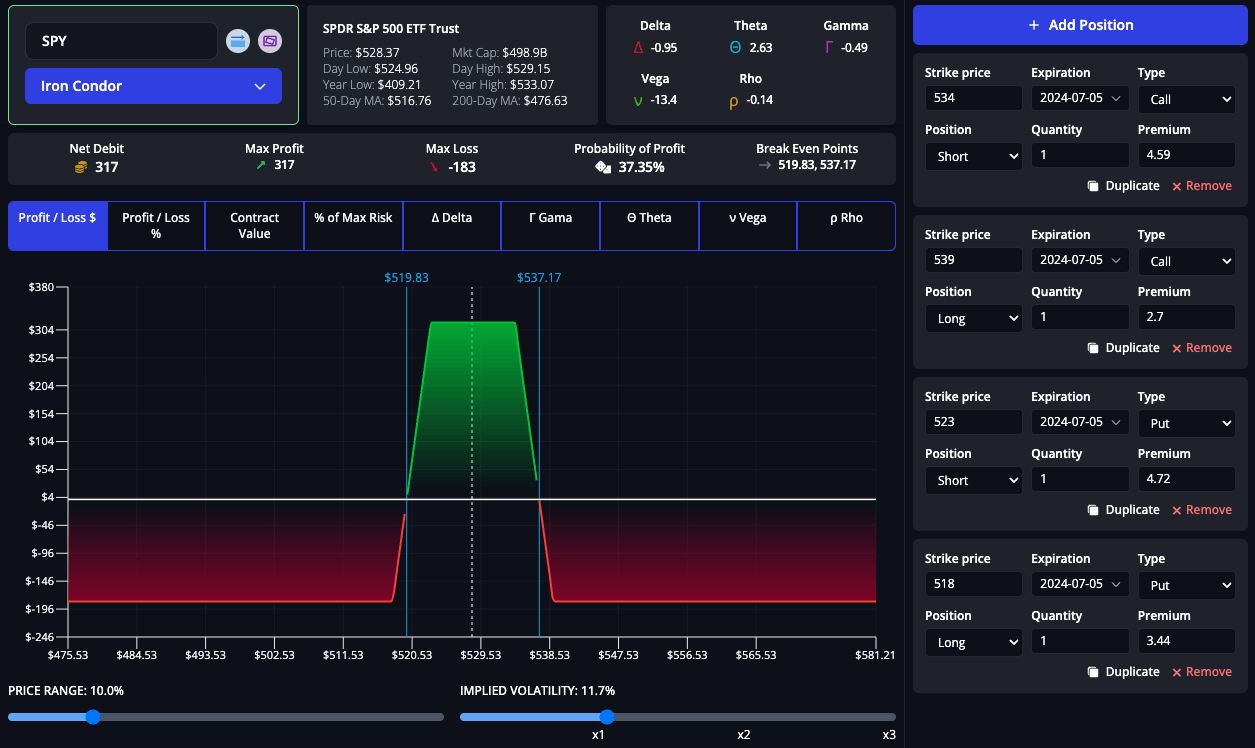

Real-World Example: SPY Iron Condor Strategy

To illustrate how an iron condor strategy works in practice, let's consider a trader using this strategy on SPY (the S&P 500 ETF).

SPY Strategy Details:

- SPY Price: $528.37

- SPY Shares Owned: 0

- Cash Held: $0

- Capital Required: Max loss

Option Legs:

- $534 Short Call with 30-day Expiration

- $539 Long Call with 30-day Expiration

- $523 Short Put with 30-day Expiration

- $518 Long Put with 30-day Expiration

Options Profit Calculator Analysis:

- Premium Received: $317

- Max Profit: $317

- Max Loss: -$183

- Probability of Profit: 37.35%

- Breakeven Price: $519.83, $537.17

Decision-Making Process:

- Objective: Generate income from both call and put spreads while minimizing risk with the purchase of further OTM options.

- Analysis Using the InsiderFinance Options Profit Calculator: The trader chooses the ticker and desired options strategy. The tool shows that the maximum profit would be $317 and the break-even prices would be $519.83 and $537.17.

- Outcome: If the SPY price remains between $519.83 and $537.17 at expiration, the trader keeps the premium, maximizing their profit. Significant movements outside this range will result in losses, capped at $183 due to the protective long options.

Key Takeaways:

- The calculator's real-time data and automated inputs provided clear insights into potential outcomes, helping the trader make an informed decision.

- The iron condor strategy effectively generated income with limited risk, benefiting from a stable underlying asset price.

Credit Spreads

A credit spread involves selling an OTM option and buying a further OTM option of the same type. This strategy aims to collect the net premium while limiting risk.

Pros:

- Generates income from the net premium received.

- Limited risk due to the purchase of the further OTM option.

- Can be used in both bullish and bearish market conditions.

Cons:

- Limited profit potential.

- Requires precise strike price selection.

- Losses occur if the underlying asset price moves significantly in the opposite direction.

Market Conditions:

- Bull Markets: Bull put spreads are more effective, involving selling a higher strike put and buying a lower strike put.

- Bear Markets: Bear call spreads are preferable, involving selling a lower strike call and buying a higher strike call.

- Low Volatility: Suitable for both bullish and bearish credit spreads as prices are less likely to move significantly, ensuring the premium is retained.

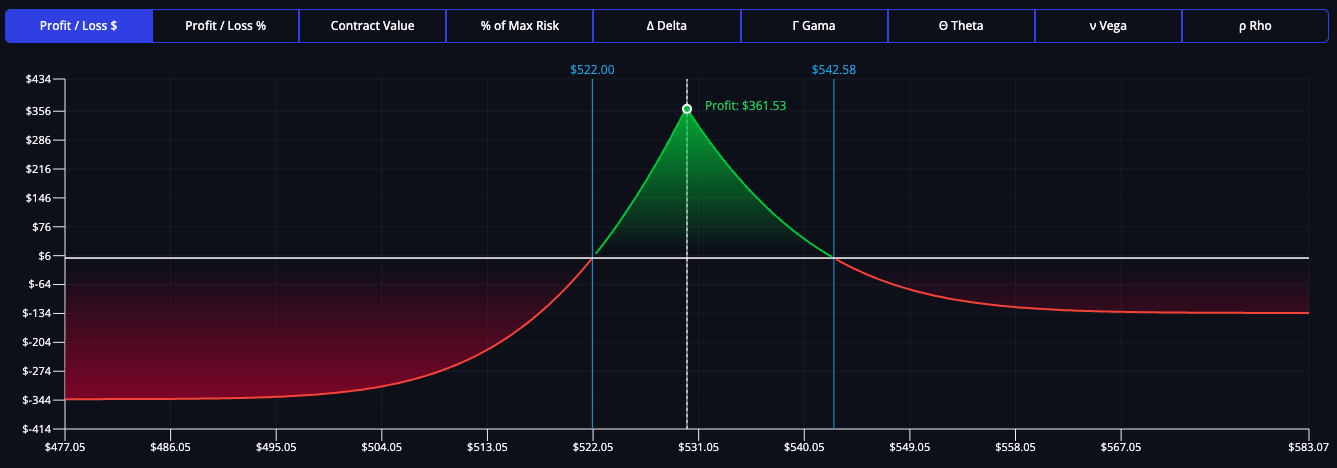

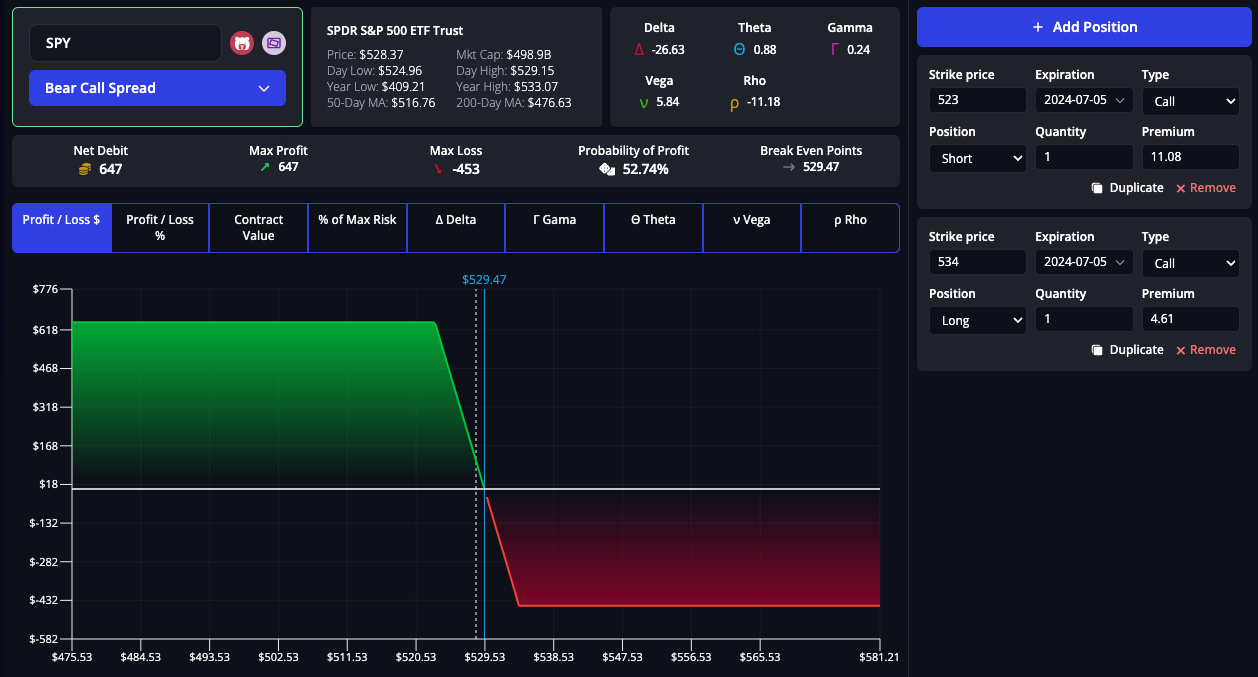

Real-World Application: SPY Credit Spread Strategy

To illustrate how a credit spread strategy works in practice, let's consider a trader using this strategy on SPY (the S&P 500 ETF).

SPY Strategy Details:

- SPY Price: $528.37

- SPY Shares Owned: 0

- Cash Held: $0

- Capital Required: Max loss

Option Legs:

- $523 Short Call with 30-day Expiration

- $534 Long Call with 30-day Expiration

Options Profit Calculator Analysis:

- Premium Received: $647

- Max Profit: $647

- Max Loss: -$453

- Probability of Profit: 52.74%

- Breakeven Price: $529.47

Decision-Making Process:

- Objective: Generate income from the net premium received while limiting risk with the purchase of a further OTM option.

- Analysis Using the InsiderFinance Options Profit Calculator: The trader chooses the ticker and desired options strategy. The tool shows that the maximum profit would be $647, and the break-even price would be $529.47.

- Outcome: If the SPY price remains below $523 at expiration, the trader keeps the full premium, maximizing their profit. If the price rises above $523 but stays below $534, the trader will experience limited losses, capped at $453 due to the protective long call option.

Key Takeaways:

- The calculator's real-time data and automated inputs provided clear insights into potential outcomes, helping the trader make an informed decision.

- The credit spread strategy effectively generated income with limited risk, suitable for various market conditions.

Next, we will explore the best options profit calculator available for options traders.

Best Options Profit Calculator

The InsiderFinance Options Profit Calculator stands out as a top choice for both novice and experienced traders due to its unique features and user-friendly design. Here's a detailed review of its features and benefits.

Features

- Real-Time Data Integration: Provides up-to-date market data for accurate profit and loss calculations.

- Strategy Optimization: Helps traders find the best strike prices and expiration dates to maximize returns.

- User-Friendly Interface: Easy to navigate, with intuitive inputs and clear visualizations.

- Comprehensive Analysis: Offers detailed breakdowns of potential outcomes, including maximum profit, maximum loss, and break-even points.

- Scenario Analysis: Allows traders to test multiple scenarios and adjust strategies based on market conditions.

- Automated Data Input: Select the desired strategy, and the calculator automatically loads the relevant data, saving time and reducing errors.

Benefits

- Accuracy: The real-time data integration ensures that all calculations are accurate and reflect current market conditions.

- Ease of Use: The user-friendly design makes it accessible for traders of all experience levels.

- Strategic Insights: The comprehensive analysis and scenario testing capabilities provide traders with valuable insights to optimize their strategies.

- Flexibility: Suitable for a wide range of options strategies, from basic to advanced, helping traders adapt to various market conditions.

By leveraging the features and benefits of the InsiderFinance Options Profit Calculator, traders can optimize their strategies, enhance their decision-making process, and maximize premium income generation.

This tool provides a comprehensive and user-friendly platform for both novice and experienced traders, making it an essential resource for anyone involved in options trading.

Earn Premium Income with Options Strategies

By understanding and applying these options strategies, traders can significantly enhance their premium income generation while effectively managing risks.

The InsiderFinance Options Profit Calculator is an invaluable tool in this process, providing accurate and actionable insights to optimize your trading approach.

Maximize your trading outcomes by using the InsiderFinance Options Profit Calculator.

- Sign up today and start optimizing your strategies with real-time data and comprehensive analysis.

- Share this guide with fellow traders and explore more advanced strategies and resources on our blog.

HIGH POTENTIAL TRADES SENT DIRECTLY TO YOUR INBOX

Add your email to receive our free daily newsletter. No spam, unsubscribe anytime.

FAQs

What is an options premium and how is it calculated?

Options premium is the price paid for an options contract. It is influenced by factors like implied volatility, time decay, and the underlying asset price.

How can covered calls generate premium income?

Covered calls involve owning the underlying asset and selling call options on it. This strategy generates income from the premiums received while holding the asset.

What are cash-secured puts and how do they work?

Cash-secured puts involve selling put options while setting aside enough cash to buy the underlying asset if the option is exercised. This generates premium income and allows potential acquisition of the asset at a lower price.

What is a Poor Man’s Covered Call?

A Poor Man’s Covered Call uses long-term call options (LEAPS) instead of owning the stock. This strategy requires less capital while still generating premium income.

How do iron condors benefit from low volatility?

Iron condors involve selling a call spread and a put spread simultaneously. This strategy profits when the underlying asset remains within a specific price range, benefiting from low volatility.

What are the pros and cons of credit spreads?

Credit spreads involve selling an OTM option and buying a further OTM option. Pros include generating income with limited risk, while cons include limited profit potential and the need for precise strike price selection.

How does the InsiderFinance Options Profit Calculator improve trading?

The InsiderFinance Options Profit Calculator provides real-time data, automated inputs, and comprehensive analysis, helping traders optimize their strategies and maximize returns.

How can I manage risk with advanced options strategies?

Effective risk management techniques include position sizing, diversification, stop-loss orders, and regular monitoring using tools like the InsiderFinance Options Profit Calculator.

What market conditions are best for iron condors and credit spreads?

Iron condors perform best in low volatility environments, while credit spreads can be effective in both bullish and bearish markets, depending on the type of spread used.

What are common mistakes to avoid when using an options profit calculator?

Common mistakes include inaccurate data inputs, overlooking fees, ignoring market conditions, not testing multiple scenarios, and failing to reassess strategies regularly.