Moderna Earnings Beat as FDA Refuses Flu Filing

Moderna earnings beat on stronger vaccine sales but an FDA refuse-to-file for its mRNA flu vaccine raised regulatory risk and knocked shares lower.

KEY TAKEAWAYS

- Q4 revenue was $678 million and GAAP loss narrowed to $2.11 per share.

- FDA CBER issued a refuse-to-file for mRNA-1010 over trial design and comparator choice.

- Company requested a Type A meeting and reiterated a 10% revenue-growth target for 2026.

HIGH POTENTIAL TRADES SENT DIRECTLY TO YOUR INBOX

Add your email to receive our free daily newsletter. No spam, unsubscribe anytime.

Moderna (MRNA) reported fourth-quarter results on Feb. 13, 2026, showing a narrower per-share loss and revenue above estimates, even as an FDA refuse-to-file letter for its mRNA flu vaccine introduced regulatory uncertainty in the U.S.

Quarterly Results and Losses

Moderna’s fourth-quarter revenue reached $678 million, exceeding the consensus range of $626.1 million to $663 million. The company posted a GAAP loss of $2.11 per share, narrower than the expected loss of $2.60, representing an 18.8% earnings surprise. Revenue declined $288 million from the fourth quarter of 2024, when sales were $966 million.

For the full year 2025, Moderna reported revenue of $1.9 billion, down 40% from 2024, with a GAAP net loss of $2.8 billion and a diluted loss per share of $7.26. The company reiterated its 2026 revenue-growth guidance of 10%, expecting roughly half of sales in the U.S. and half internationally, while planning GAAP operating-expense reductions.

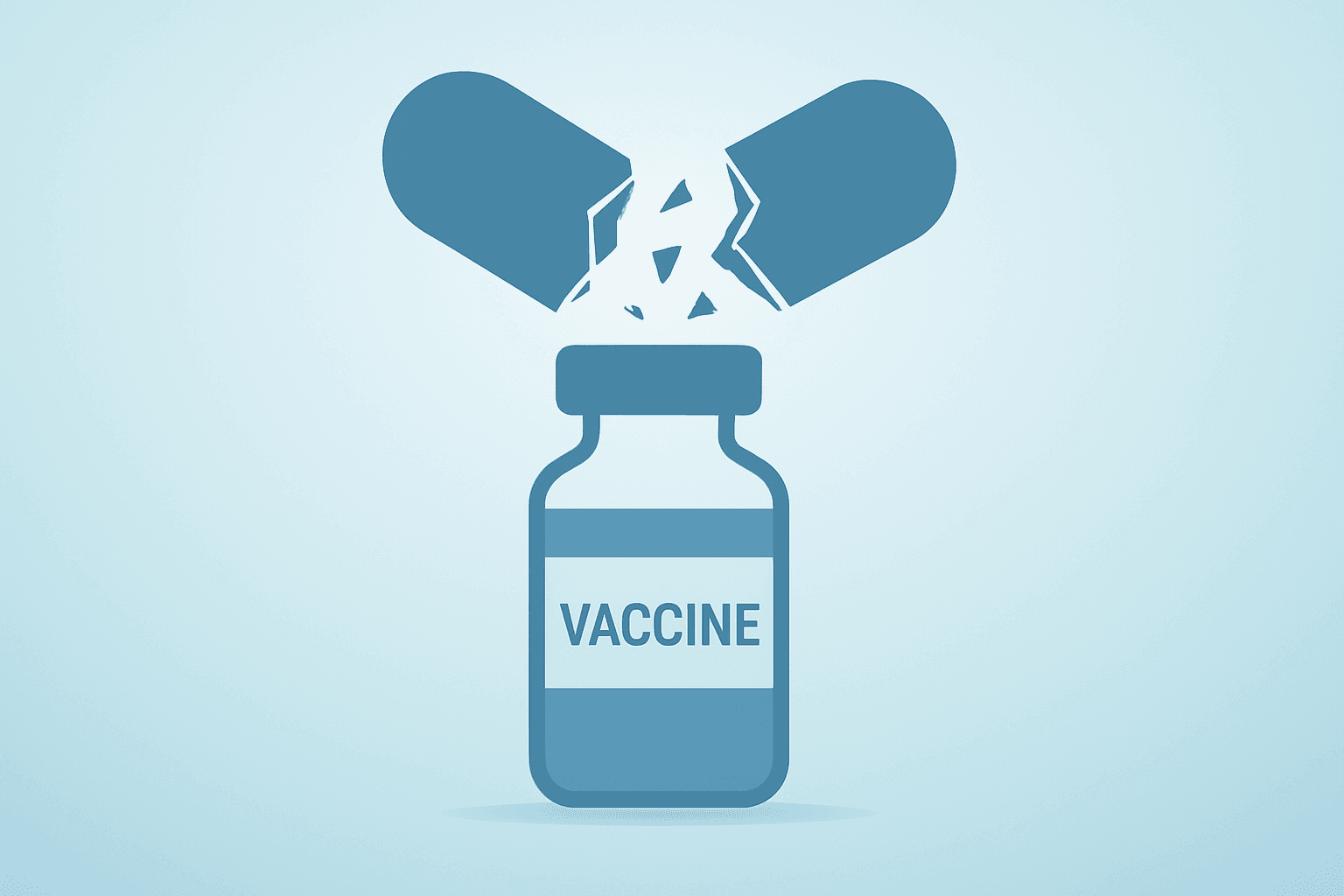

FDA Refuse to File and Outlook

On Feb. 10, 2026, the FDA’s Center for Biologics Evaluation and Research issued a refuse-to-file letter for Moderna’s seasonal influenza vaccine candidate mRNA-1010. The agency said the Phase 3 trial lacked an adequate and well-controlled design and objected to Moderna’s choice of comparator, a standard-dose flu shot, rather than the high-dose vaccine recommended for older adults. The letter did not cite any specific safety or efficacy concerns.

Moderna disputed the decision, noting the Phase 3 trial was fully enrolled with about 41,000 participants and met all endpoints by mid-2025. The company said CBER had accepted the study design in April 2024 and raised no objections at protocol submission or trial launch in September 2024. Moderna has requested a Type A meeting with CBER and its applications for the vaccine have been accepted for review in the EU, Canada, and Australia.

Following the FDA letter, Moderna’s shares fell 9.3% to $38.09 in premarket trading on Feb. 11. The company plans to reduce GAAP operating expenses in 2026 while pursuing other clinical and commercial milestones. Its Phase 3 norovirus study is fully enrolled with data expected in 2026, and a Phase 2 bladder-cancer trial is also fully enrolled. Moderna launched a third product and brought three international manufacturing sites online in 2025.