In the Money vs. Out of the Money Options Trades

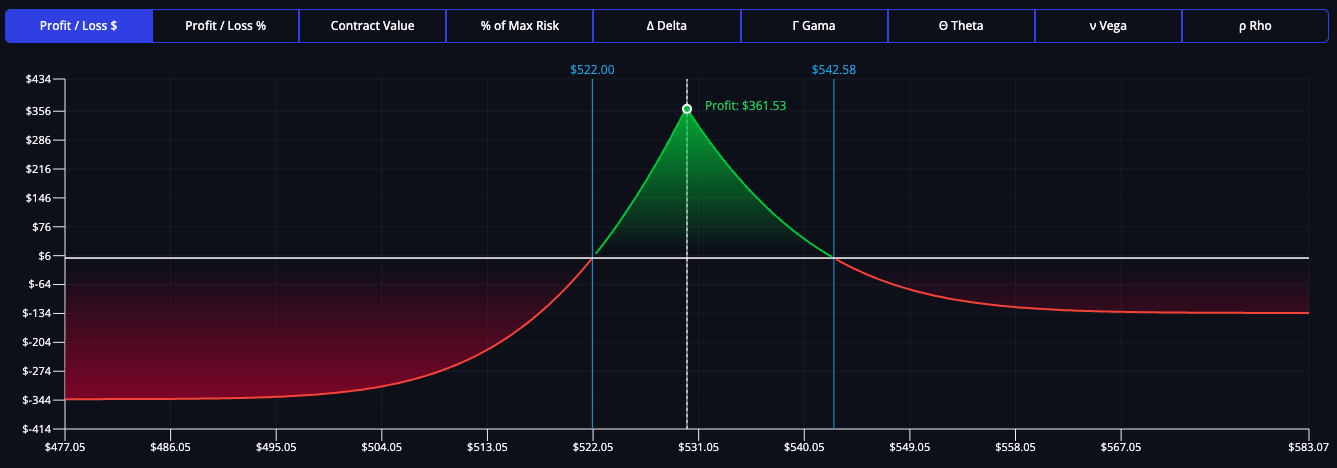

An option is considered to be “in the money” when a stock’s current price is greater than the option's strike price.

This means the option contract has intrinsic value because it could be exercised for a profit.

In other words, the option contract’s strike price is favorable in comparison to the current spot rate of the underlying stock.

By contrast, an option contract is considered to be “out of the money” when a stock’s price is less than the strike price.

However, an option can still have value because the underlying stock price continues to change before expiration.

This means it could eventually become “in the money” and yield a profit.

Because an option contract's value can be based on its volatility and possible movement before expiration, we still must pay a premium for out-of-the-money options.

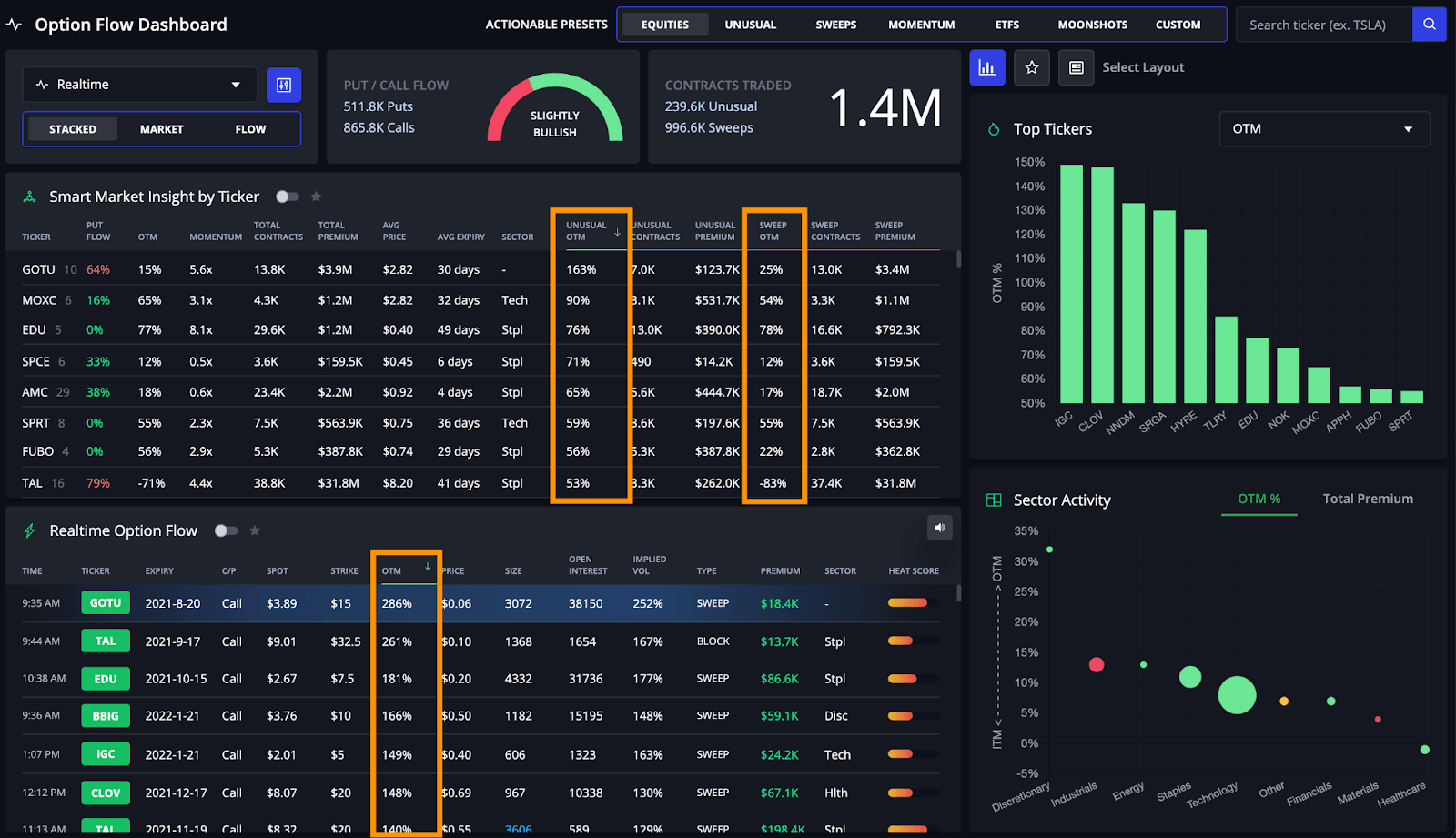

InsiderFinance makes it easy to identify which options contracts are in the money or out of the money with the OTM % (Out of the Money Percent) fields in the dashboard as shown below:

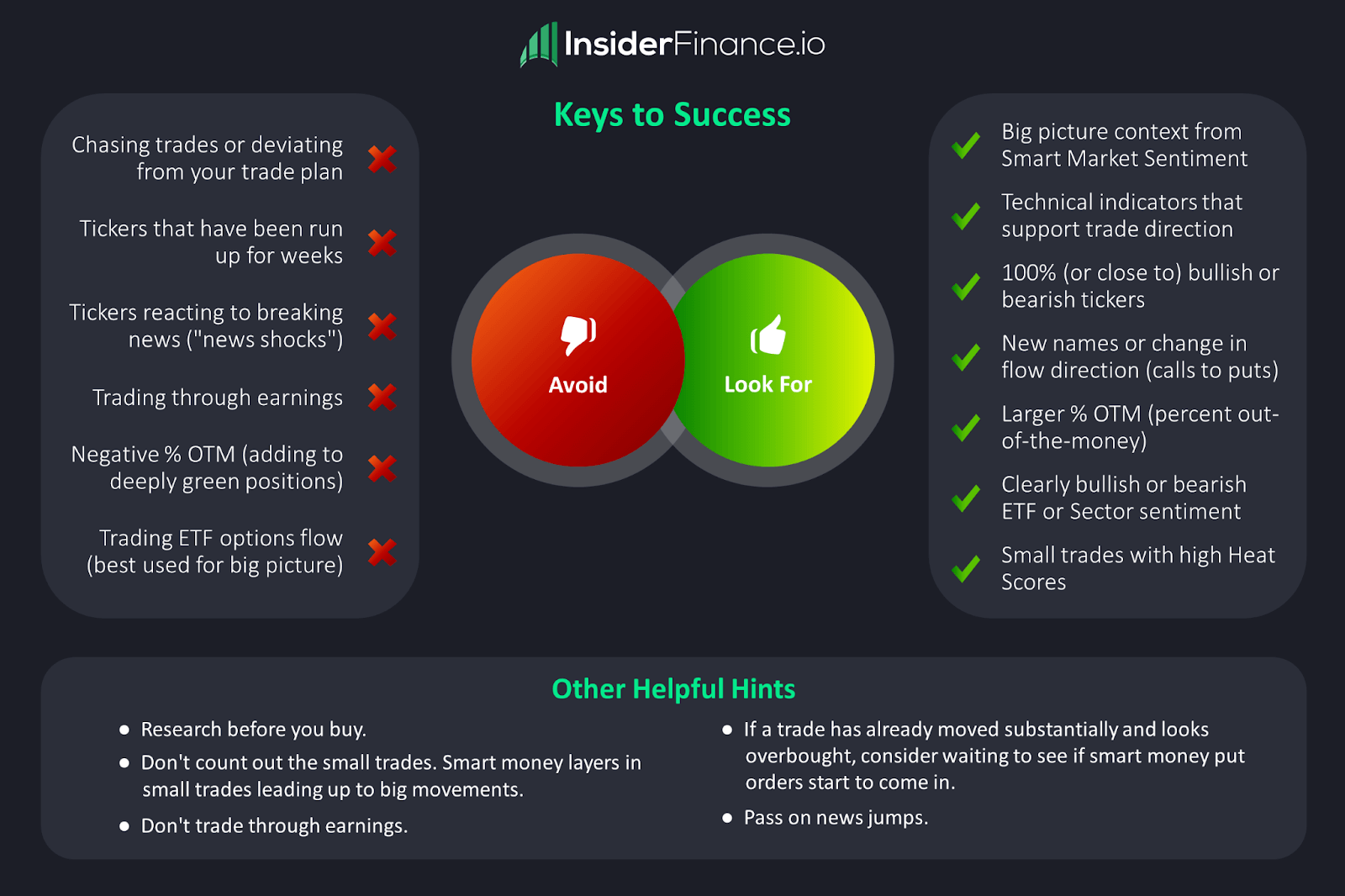

OTM % represents how far the strike price is above (for calls) or below (for puts) the stock's market price at the time of purchase.

OTM % serves as a good indicator of how much Wall Street is expecting the underlying stock price to move.

High OTM % trades imply an expectation for big price swings in the underlying stock, which often leads to even more significant increases in the option value.

Any ticker over 7% OTM would be a good candidate, as there is a 7% expectation of stock movement.

If a stock moves 7%, an option contract could increase in value by 200% or 300%.

HIGH POTENTIAL TRADES SENT DIRECTLY TO YOUR INBOX

Add your email to receive our free daily newsletter. No spam, unsubscribe anytime.