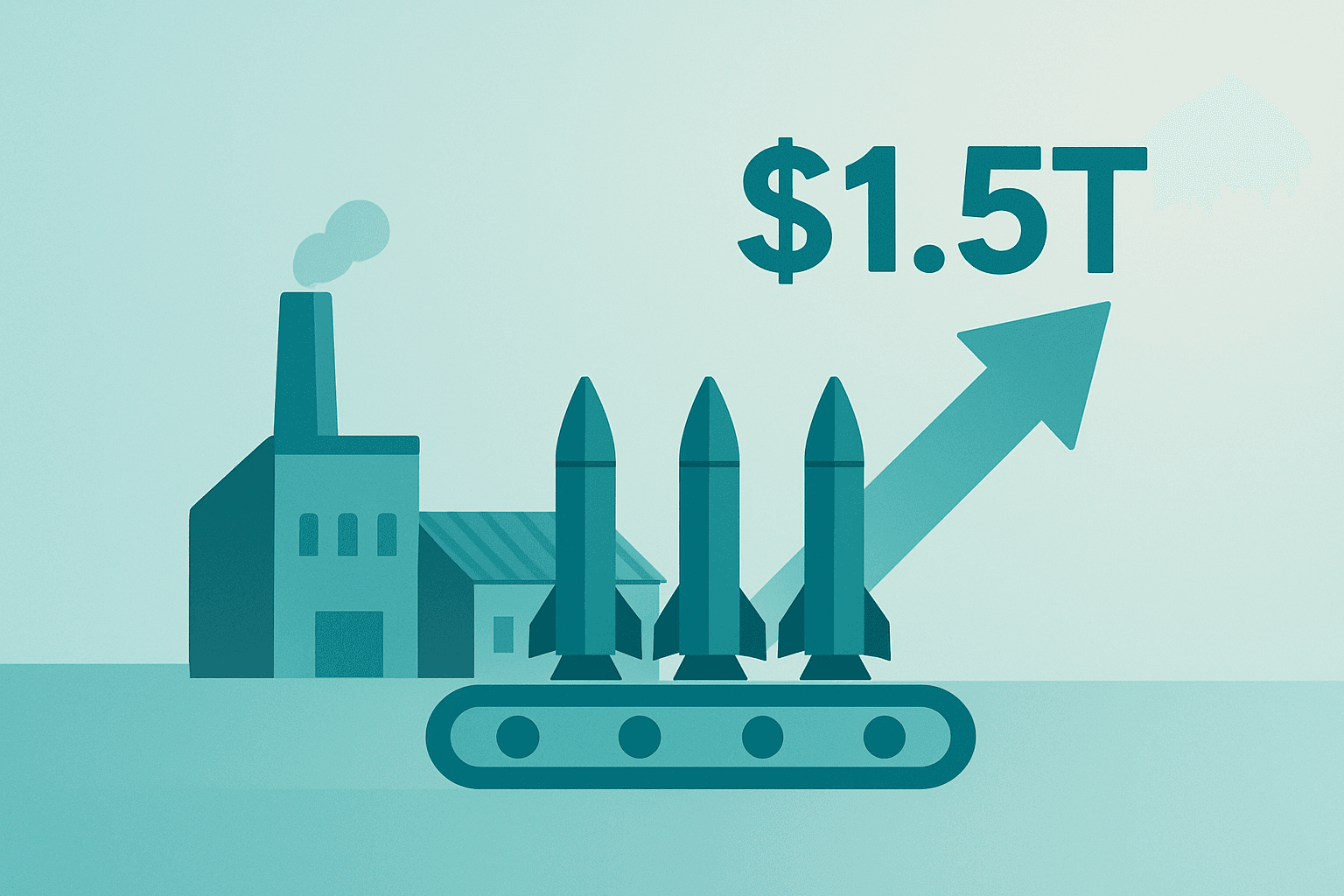

Trump $1.5 Trillion Defense Budget Sparks Rally

Trump $1.5 trillion defense budget call lifted defense stocks as traders repriced a longer defense-spending cycle and boosted sector flows.

KEY TAKEAWAYS

- Trump's call for a $1.5 trillion FY2027 defense top line lifted defense stocks as traders repriced procurement cycles.

- Lockheed Martin's prior quarter showed EPS $6.95 and revenue $18.61 billion, each above consensus.

- A $1.5 trillion top line would extend procurement cycles and boost demand for primes and suppliers.

HIGH POTENTIAL TRADES SENT DIRECTLY TO YOUR INBOX

Add your email to receive our free daily newsletter. No spam, unsubscribe anytime.

Lockheed Martin and other defense contractors rallied on Jan. 8, 2026, after President Donald Trump posted on Jan. 7 that the FY2027 U.S. military budget should be $1.5 trillion, lifting sector equities as traders priced a potentially longer defense-spending cycle.

Trump Calls for $1.5 Trillion Defense Budget and Criticizes Contractors

On Jan. 7, Trump posted on Truth Social that the FY2027 military budget "should not be $1 Trillion Dollars, but rather $1.5 Trillion Dollars," citing "very troubled and dangerous times." These posts were policy statements on social media, not a formal budget submission, and the administration had not sent a FY2027 Pentagon request to Congress. Congress must approve defense appropriations, and full-year FY2026 appropriations had not been passed at the time.

Trump sharply criticized defense contractors for slow deliveries, limited investment in production plants, and heavy use of dividends and stock buybacks. He said companies must build new, modern production facilities and immediately enhance maintenance and repair. He signaled he would seek to block dividends and buybacks and cap executive pay at $5 million until these issues are resolved.

The Committee for a Responsible Federal Budget (CRFB) modeled the fiscal path tied to that target and estimated it would raise cumulative defense spending by roughly $5 trillion through 2035 and add about $5.8 trillion to federal debt including interest. The group called the path unrealistic and said tariff offsets cited by the administration did not add up.

Market Reaction and Lockheed Martin Context

On Jan. 8, U.S. and European defense equities rose as traders priced the prospect of larger, longer procurement outlays. Secondary reports described a sector surge of about 8%, while broader indices showed profit-taking.

Lockheed Martin’s most recent quarter showed earnings per share of $6.95 on revenue of $18.61 billion, each modestly above consensus. The next earnings report is scheduled for Jan. 29, 2026, with consensus estimates projecting EPS of $6.33 and revenue of $19.72 billion. Valuation metrics include a forward price/earnings ratio near 17.7, a price/earnings-to-growth (PEG) ratio around 1.48, trailing 12-month revenue near $71 billion, and an enterprise value near $133.7 billion.

A multi-year agreement to ramp production of PAC-3 MSE Patriot interceptors from roughly 600 to about 2,000 units annually was highlighted as a key demand driver. This expansion implies a sustained increase in production, backlog, and revenue visibility for missile suppliers over about seven years.

Market commentary framed the rally as led by major U.S. primes and tied to expectations that a larger top line would extend procurement cycles and boost demand across contractor supply chains.

“I have determined that, for the Good of our Country, especially in these very troubled and dangerous times, our Military Budget for the year 2027 should not be $1 Trillion Dollars, but rather $1.5 Trillion Dollars.” — Donald Trump [source:1]