NIO First Profit Signals Q4 Turnaround

NIO first profit alert shows an adjusted operating profit of US$100M-US$172M for Q4 2025 and forces traders to weigh durability before mid-March results.

KEY TAKEAWAYS

- NIO expects its first quarterly adjusted operating profit of about US$100M-US$172M for Q4 2025.

- The improvement was driven by higher vehicle sales, ES8 mix and cost reductions.

- Audited Q4 and FY2025 results are expected in mid-March 2026.

HIGH POTENTIAL TRADES SENT DIRECTLY TO YOUR INBOX

Add your email to receive our free daily newsletter. No spam, unsubscribe anytime.

NIO Inc. said in a GlobeNewswire profit alert on Feb. 5, 2026, that it expects its first quarterly adjusted operating profit for Q4 2025, driven by higher vehicle sales and cost controls. The company will publish audited Q4 and full-year 2025 results in mid-March 2026.

Profit Alert and Figures

NIO projected an adjusted profit from operations (non-GAAP), excluding share-based compensation, of about RMB700 million (US$100 million) to RMB1.2 billion (US$172 million) for Q4 2025, marking its first quarterly adjusted operating profit. On a U.S. GAAP basis, it expects operating profit between RMB200 million and RMB700 million. This contrasts with a non-GAAP adjusted operating loss of RMB5.54 billion in Q4 2024. The company described these figures as preliminary and unaudited, pending review by its independent auditor and audit committee.

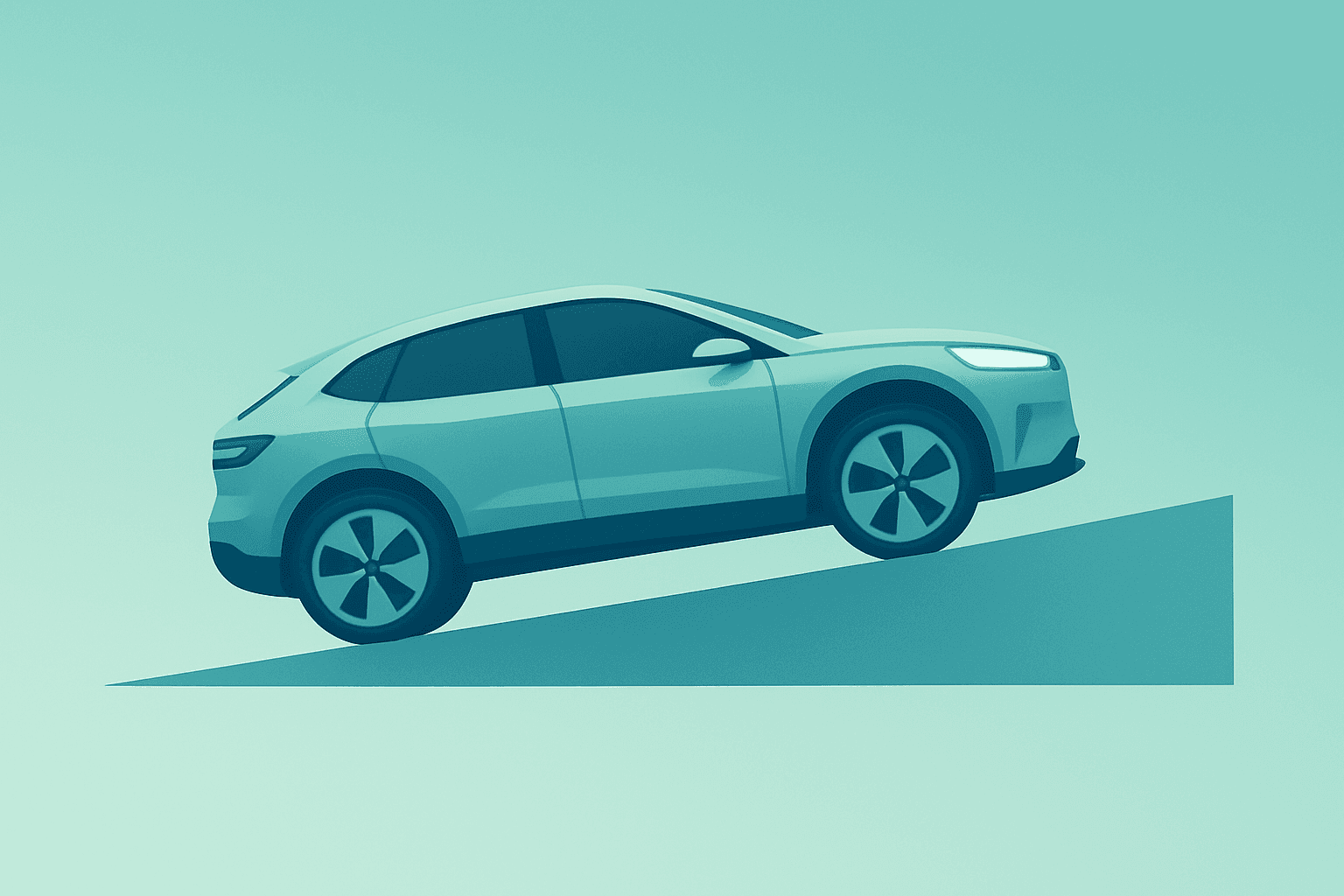

Delivery Mix and Outlook

The improvement reflects higher vehicle sales, a favorable product mix led by the third-generation ES8, cost reductions, and operational efficiency. The ES8, with an estimated gross margin near 20%, accounted for more than 40,000 units delivered in 2025, mostly in the fourth quarter. Cumulative ES8 deliveries reached 60,000 by Jan. 30, 2026. In January, the ES8 made up roughly 65% of NIO’s total deliveries, with 17,646 units out of 27,182 vehicles. January deliveries rose 96% year-on-year but fell 44% month-on-month.

NIO flagged near-term challenges for Q1 2026, including a seasonal slowdown, the phase-out of purchase subsidies, a 5% purchase-tax increase, the Chinese New Year holiday from Feb. 15 to 23, and rising raw-material costs such as memory chips and metals. Industry new-energy vehicle wholesale volumes were roughly flat year-on-year in January but declined about 42% month-on-month, indicating a sharp short-term pullback that could limit momentum from the strong quarter-end.

The company is preparing audited Q4 and full-year 2025 financial results for release in mid-March 2026. Investors will assess whether the preliminary profit reflects a lasting operational shift or a quarter-specific combination of strong ES8 deliveries and one-time cost measures amid industry headwinds.